Fintech in LATAM | EY | Startupbootcamp FinTech | IPADE

A Two-Way Path Coopetition between Financial institutions and FinTechs, a look at Latin America

A TWO-WAY PATH Coopetition between financial institutions and FinTechs, a look at Latin America A TWO-WAY PATH 1

tartupbootcamp FinTech is the leading global accelerator, specialized in innovation for the financial industry. Launched in 2014, it operates in Lon- Sdon, Amsterdam, Singapore, New York, Dubai and Mexico City. Each program is supported by a global network of partners from across financial services, as well as a wide network of mentors and alumni from more than 40 countries around the world. Startupbootcamp FinTech in Latin America is an initiative formed in collaboration with Finnovista, the impact organization that empowers FinTech ecosystems across Latin America and Spain. Finnovista operates two programs to support FinTech startups in Mexico City: an acceleration program, Startupbootcamp FinTech Mexico City, and a scale program, Startupbootcamp Scale FinTech Mexico City. Startupbootcamp FinTech Mexico City and Startupbootcamp Scale FinTech Mexico City are locally supported by eight entities to which we specially thank for their par- ticipation in drafting this report: Visa, Fiinlab (powered by Gentera), Banregio, HSBC Mexico, EY Mexico, IGNIA, Latinia and White & Case.

AUTHOR José Antonio Director of the Research Center for Business Entrepreneurial Initiative Dávila Castilla - EY (CiiE-EY) | IPADE COLLABORATORS Myriam Moreno Assistant Director of CiiE-EY | IPADE Eduardo Morelos Program Director | Startupbootcamp FinTech Mexico City Gonzalo Sánchez Operations & Portfolio Manager | Startupbootcamp FinTech Mexico City Montserrat Bonilla Marketing Manager | Startupbootcamp FinTech Mexico City Paola Parra Manager, FinTech | EY Mexico Guillermo Ortega COO | Mexico Media Lab Addy Góngora Business Development Coordinator | Mexico Media Lab Rossana Fuentes CEO | México Media Lab COMPANIES PARTICIPATING IN THIS STUDY Alkanza Andrés Villaquirán | Founder and CEO BanregioLABS Demetrio Strimpopulos | Director BDEO Julio Pernía | Cofounder and CEO Creditas Sergio Furio | Founder and CEO Cubo Reynaldo Pestana Saldanha Gama | Operating and Business Manager DILE Esteban Marín | Cofounder and CEO Fiinlab Jorge Gutiérrez | CEO HSBC México Juan Carlos Espinosa | Director of Digital Strategy and Innovation Payit Martín Mexía | Cofounder and CEO RSK Henry Sraigman | Business Development Director Tesseract Ricardo Arenas | Cofounder and CEO Francisco Illescas | Cofounder and Chief Marketing Officer Visa México Juan Carlos Guillermety | Product Vice-president Visa Greater Latin Allen Cueli | VP of FinTech Engagement America and Caribbean A TWO-WAY PATH 3

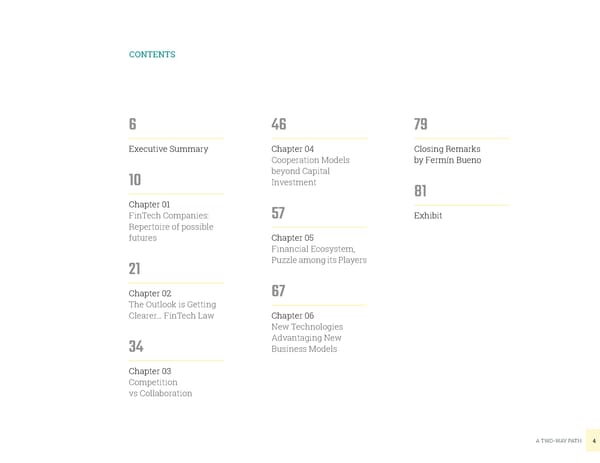

CONTENTS 6 46 79 Executive Summary Chapter 04 Closing Remarks Cooperation Models by Fermín Bueno beyond Capital 10 Investment 81 Chapter 01 FinTech Companies: 57 Exhibit Repertoire of possible futures Chapter 05 Financial Ecosystem, 21 Puzzle among its Players Chapter 02 67 The Outlook is Getting Clearer… FinTech Law Chapter 06 New Technologies Advantaging New 34 Business Models Chapter 03 Competition vs Collaboration A TWO-WAY PATH 4

ore than an epoch of changes, we are witnessing a change in which industries are reinventing themselves and traditional boundaries are being broken down. MNowadays, talking about financial technology (FinTech) means addressing a transformation that touches all the points of the value chain in any industry. The new business models emerging from this transformation generate risks and op- portunities, where the trade of some and innovation of others meet, just like metals combining to generate new, stronger and more useful alloys. The acceleration program, Startupbootcamp FinTech Mexico City, launched by Fin- novista in 2017 with a regional focus for Latin America, is remarkable. It is a platform for regional and global leaders of the financial industry such as Visa, Gentera, Banre- gio, HSBC, EY, IGNIA, Latinia and White & Case, to interact with FinTechs, like those included in this study, which are brand new startups, whose names are not publicly known yet, but undoubtedly will be in the near future. EY is a global organization of 212,000, sharing their ideals and passion to help build a better business environment. EY is the alchemist contributing to the development of new FinTech companies, and works with traditional financial institutions in their reinvention process. EY’s findings contribute to improving the business environment of the entire finan- cial industry and offer its community a wider outlook on radical regulatory changes, market volatility and demands for greater transparency across financial services. A TWO-WAY PATH 5

EXECUTIVE SUMMARY Technology is the catalyst for change and the financial industry is not exempt: en- terprise FinTechs are the ‘avalanche’ shaking up the banking industry as we had come to know it. Over the last decade, the financial industry has witnessed how new technology has tried to gain a place in the value chain of banking services. This study, based on a sample composed of five financial entities and a selection of entrepreneurs ―some of them associates of Startupbootcamp FinTech― gathers five key findings related to the emergence of FinTechs and their interaction with the financial system. 1 FinTech Law Latin America is home to more than 1,100 FinTechs. It is consolidated as a regional in Mexico has contributed leader in terms of innovation in the financial sector. Mexico has become a pioneer in offering a ‘surfing map’ approved by “FinTech Law”, which has no precedent on a to the future regional basis. This legislation places the customer at the center, allowing the customer of data usage and new to take control of his personal data, generated during any interaction with banking services. It considers a legal framework for innovators to prove the profitability of business models. new business models before deploying them, and certainly operate new concepts, such as crowdfunding, e-payment institutions and virtual assets. In other words, the FinTech Law makes the outlook clear for financial institutions and entrepreneurs, to find a level playing-field, a common language and clear rules that also allow them to explore collaboration. A TWO-WAY PATH 6

2 The symbiosis The myth that “dinosaurs” and “unicorns” cannot understand each other because between FinTechs they cannot communicate has started to fall apart - evidence that the weakness of one is the strength of another, and that symbiosis is not only possible but urgent. and financial institutions Large financial institutions (“dinosaurs”) need FinTechs (“unicorns”) to identify the is not only possible innovations promising to have a large impact on the industry, and FinTechs need the financial institutions to gain access to the market, allowing them to scale rapidly. but also urgent. Depending on their maturity and purpose, FinTechs adopt different roles in relation to the financial institutions: some are technology providers to large institutions, that allow them to issue white label products to improve the offer; some are challengers trying to compete in the same service categories; and others are disruptors promising to change the rules of play in the industry. 3 Collaborative For the alliance between FinTechs and financial institutions to be successful, the latter programs between must be in the right mindset to change towards an open innovation model. To initiate a transformation with the objective of redefining the future of financial services, the FinTechs and financial ideas generated within the organization are simply not enough. The next step is to institutions allow an have extremely clear targets and objectives before connecting with entrepreneurs: which can be anything from contributing to accelerate a change of culture within exchange of innovation, it the organization, solving internal business challenges through new technological is a two-way path. solutions, or exploring and escalating new high-impact opportunities in the market. After setting a clear agenda, the collaborative process is designed, which essentially includes three steps: scouting, pilot and implementation; and even investment. FinTech innovations have a place in this two-way path. Collaboration is therefore also very attractive to entrepreneurs. The most successful corporate acceleration and innovation programs have elements facilitating the growth of startups, such as the offer of shared services, access to know-how or technological platforms, connection with clients and financing sources, as well as promoting the collaboration among entrepreneurs. A TWO-WAY PATH 7

4 Innovation Innovation is not framed only in the individual context of enterprises. In the 1960’s in the financial sector and 1970’s, with the introduction of credit cards, Visa changed the rules of play for the whole ecosystem, and success of its implementation depended on the generation cannot be fully understood of coordinated mechanisms. Dee Hock, Visa’s first CEO, conceived and executed a without the strong vision similar to that of many FinTech entrepreneurs nowadays: to use technology to radically enhance the banking experience across the industry. interdependence among the players forming Seeing the financial industry as an ecosystem enables challenges to be transformed into opportunities to improve the financial industry as a whole, by using technologi- an ecosystem. cal innovation. For example, the challenge of falling behind in financial inclusion is being addressed by some FinTechs. Widening the offer of more customized products and giving access to financial services, cutting transactional costs and entry barriers for a population segment that has been excluded, consequently increases the total size of the market participating in financial activities. Likewise, the challenge of creating a better banking experience is being addressed by financial institutions that are opening their technological infrastructure and databases through APIs; enabling potential entrepreneurs to use their creativity to design new business models. Converting the financial entities into platforms for others may develop technology-based products and services, which is also known as Open Banking. A TWO-WAY PATH 8

5 Technological The direction currently being taken to address the challenges and opportunities for innovation driven financial ecosystems is respondent to the data economy: how data is generated, made available, structured, protected, conveyed, analyzed, visualized and, finally, how the by FinTechs is focused. data is converted into operable resources, and used to build better products for the In the short term, a more customer’s benefit. intelligent and safer use Growth of technological companies leading the data economy has caused many to of data is generated by state that “data is the new oil”, and some leaders of the financial industry have de- clared that the banks will convert into software companies. financial activity. In the long term, there is We have to take a close look at how the alliance between financial institutions and FinTechs allow the large data deposits managed by the former to combine with the potential in the application technological instruments developed by the latter. These include predictive algorithms, of blockchain. customized recommendation engines, tokenization and distributed ledgers, and how such combinations promise to accelerate further the dynamics of the financial ecosystem, making an impact and transforming the world we inhabit. A TWO-WAY PATH 9

chapter SOMETHING IS CHANGING IN THE LATIN-AMERICAN 01 FINANCIAL SCENE FinTech Companies: From Rio Grande to Patagonia, Latin America has vigorously joined the FinTech Repertoire of possible futures revolution during the last few years, by creating ecosystems that foster innovative and entrepreneurial talent, in collaboration with those partners from the historical trade of Banking. Simple financial, as well as other highly innovating, products and services, have started being offered to unbanked or sub-banked populations that, in the unlikely event of having them, pay extremely expensive prices for the few services received. We will share herein some stories and explore the origin of the myths surrounding old and new players. For example, we will talk about “dinosaurs” and “unicorns”, provided, however, that neither the former –the consolidated institutions– will disappear from Earth nor the latter –the new players– will rocketeer by themselves to the firmament. In the studied universe composed of thirteen cases, both of those of the historical trade and new talents, all of them profusely share their experience on this climate with a shared certainty: the best is yet to come. An example is the high investment in the sector: 55% of the risk capital on IT in Lat- in America goes to the FinTech sector (Ruvolo, 2017) according to different reports by LAVCA, Finnovista and IDB (see Pictures 1 and 2) which identify more than 1,100 regional startups. A TWO-WAY PATH 10

MEXICO DOMINICAN 25.6% REPUBLIC HONDURAS 0.3% GUATEMALA 0.1% 0.4% VENEZUELA 0.6% NICARAGUA 0.1% OTHERS 1.6% COSTA RICA COLOMBIA 0.7% 11.9% BRAZIL 32.7% PANAMA ECUADOR 0.1% 1.8% PARAGUAY 0.7% PERU 2.3% URUGUAY PICTURE 1 1.7% Distribution per country of Latin American FinTechs CHILE Source: Finnovista, Inter-American 9.2% ARGENTINA Development Bank, 2017 10.2% A TWO-WAY PATH 11

However, up to now, no emphasis has been added to the qualitative aspect of this quantitative reality, because there are many, indeed, but… why this has happened? how is investment composed? what is the current status of the bilateral relationship between FinTech entrepreneurships and financial institutions in Latin America? That is why we decided to begin a pertinent discussion about the status itself of FinTechs and the recent legal framework within FinTechs (chapter 2), but also sur- rounding the relationship of cooperation-competition within Banking (chapter 3). The rules of play in several industries are changing and the financial industry is leading this trend: in Mexico City, Buenos Aires, Santiago de Chile, São Paulo, Lima, Quito or Bogota, among many other cities in the region, we are witnessing a change led by young companies responding to and claiming satisfaction with solutions that are better suited to the financial needs of local markets. PICTURE 2 Investments of Risk Capital and FinTech in Latin America USD $500 M Risk Capital Investment in Latin America Startups in Latin America raised USD $500 million in risk capital. USD $342 M Risk Investment in IT The largest share of this money, USD $342 million, was invest- ed in the IT sector. Risk Investment in FinTech 25% of risk capital investment in the IT sector in the region was 25% made in FinTech subsector. Dollars in FinTech 55% FinTech raised 55% of dollars invested in IT in Latin America. Source: LAVCA, 2016 A TWO-WAY PATH 12

chapter 01 ORIGIN AND DEPLOYMENT OF FINTECH IN LATIN AMERICA Even though the term FinTech is new, technology has always had a role to play in the financial sector. The first Latin-American apps date from deployment of auto- matic teller machines in 1972, the emergence of the first banking credit cards were between 1950-1975, and implementation of the first online banking system in the region, documented in 1965, among others (chapter 5). At that time, all these tools represented huge innovation, facilitated the banking tasks, as well as interaction with customer, defining the path to be followed by the financial industry. However, that took place more than 50 years ago. Nowadays, these tools that, at that time, revolutionized financial services are becoming obsolete. When these innovations were conceived, the Internet and the idea of a banking service not linked to a physical branch were highly unimaginable. Now, the unimaginable is a disconnected world. Recent technological history identifies the first instance of the current worldwide FinTech wave was in the ’90s with the generalized adoption of the Internet, the emer- gence of Digital Banking and the first e-commerce websites. If we want to give a proper name to identify the genesis of this phenomenon, it is PayPal, the startup where Peter Thiel and Elon Musk met, and reached the public in 1998 as a digital payment platform. It currently has more than 237 million active us- A TWO-WAY PATH 13

ers performing transactions, out of which Mexico registered 2 million active users in 2017. Mexico is the most important market for PayPal in Latin America (PayPal, 2018). According to the information available in the report FinTech: Innovation You did not Know was from Latin America and the Caribbean (IDB and Finnovista, 2017), the FinTech movement is a very recent phenomenon in the region. The report shows that 60% of the participating startups were created three years ago or less, and only 18% stated having been created more than five years ago. The FinTech adoption rate When television was created, it was thought that it was the end of movies; when the is barely 33%, which indicates Internet was born, it was said newspapers would come to an end. The predictions regarding any significant change or revolution, in any industry, have always been that this type of company still has much fatalistic speculation. There are often a lot of false ideas about how technology will to do to cement themselves. impact the current state of affairs, however, in practice, these supposed paradigm changes never substitute completely to the state of the previous art. This was also experienced by the financial industry following the arrival of FinTechs. Why? Because the old paradigm is still useful and generates value. The new and old financial models exist alongside one another: while some consumers adopt the new financial services, there will always be other consumers continuing to find value in the traditional proposal. The adoption rate of FinTech is barely 33% (EY, 2017) worldwide, which indicates that FinTech companies have a long road ahead to position themselves among the most conservative users. However, it is difficult to know how long these users will continue looking at both sides: the old model which they are familiar with and new financial services that may offer a better alternative. While it is impossible to predict what the future of the financial industry will be in the next ten years, the banking sector is learning to cohabit with FinTechs in a market dynamic different from the usual, where the forces of competition and collaboration only came from other banks. A TWO-WAY PATH 14

Meanwhile, financial institutions have discovered they may collaborate with, instead of competing against, the FinTech companies through so-called ‘open innovation’ and collaboration with agents such as Startupbootcamp FinTech to achieve several purposes: to efficiently identify new business opportunities, shorten their learning curve, attract talent, promote a more entrepreneurial and collaborative culture within the organization, cut costs and risks for launching their own innovations, exploit their own technology through different mechanisms and gain new clients (Rojas, 2016). Moreover, by working with FinTechs, the banks may expand their service offering worldwide, reach previously untapped potentials users and access new income sources, without making an investment in developing new technological infra- structures. From the point of view of FinTech companies, FinTechs benefit from the experience, backup and –economic and market– resources the banks may provide to them through collaboration. A TWO-WAY PATH 15

chapter 01 NARROWING GAPS WITH TECHNOLOGY FinTech employers in Latin America have developed a wide variety of products and services to serve segments untouched or not properly attended to by the traditional financial system. Thanks to the lower costs of distribution of financial services and the increase in the forms of Internet access for the population in general, it has been possible to respond to the financial needs of a public previously excluded or under- served by traditional financial services, whether they are individuals or small and medium-sized enterprises (SMEs). For example, if we talk about exclusion, numbers are clear: more than half of Lat- in-Americans have no access to any type of financial services, while Banking costs for the other half are high. With different stages of maturity, the FinTechs seek to address a diversity of market segments (see Picture 3). The predominance of alternative financing platforms and digital payment solutions stand out, which together account for slightly more than half (50.8%) of the offer. The financial inclusion approach is also notable: 41% of FinTech startups monitored by Finnovista through its FinTech Radar initiative and the aforementioned FinTech industry report, are seeking to serve the unbanked or under-banked consumers or SMEs, as their main clients. A TWO-WAY PATH 16

OTHERS* PICTURE 3 Distribution per segment 12.7% of Latin American FinTechs PERSONAL FINANCIAL MANAGEMENT 9.8% ALTERNATIVE FINANCING PLATFORMS TRADING AND 25.6% STOCK MARKET 5.5% PAYMENTS 25.2% TECHNOLOGY COMPANIES FOR FINANCIAL ENTERPRISE FINANCIAL INSTITUTIONS MANAGEMENT 8% 13.2% *OTHERS 12.7% 1% ALTERNATIVE SCORING 1.4% FINANCIAL EDUCATION 1.4% DIGITAL BANKS 4% INSURANCE Source: Finnovista, Inter-American 4.8% Development Bank, 2017 WEALTH MANAGEMENT A TWO-WAY PATH 17

chapter 01 HOW FINANCIAL INSTITUTIONS RESPOND? Recent changes in technology and population trends highlight on the main lessons that the FinTech wave has brought to banks: that the banking sector is also vulner- able to disruption. It should be noted that most of the potential innovations that may define the indus- try’s future are emerging from small technology companies and not from the large banks, who have the scope, resources and experience, allegedly ‘an ace under their sleeve’, when it comes to innovation. Nonetheless, is there enough room in the market for both: new innovator players and traditional banks and financial institutions? How is the latter being threatened in Latin America? Do they compete? Do they cooperate? Or do they do a little bit of everything? Until the beginning of the 2008 financial crisis, banks had enjoyed a degree of confi- dence and popularity that were crucial to the growth and positioning of their brands and, although that trust has not been eliminated completely, it has decayed around the world, mainly in the face of the needs and profile of new generations. As an example, the outcome of “Millennial Disruption Index” (Scratch, Viacom Net- work, 2015), states that 71% of US millennials said they prefer to go to the dentist rather than calling their bank; 68% considered that within five years the way people have access to money will change; and 70% stated they believed that forms of payments A TWO-WAY PATH 18

will be totally different within the same period of time. However, more alarming data is that 33% of interviewed people expressed their belief they would not need financial institutions in the coming years. Amazon is deliberating on whether to add a person-to-person payment feature to its popular virtual assistant Alexa. An idea that would allow drivers in Alexa-enabled cars to pay for gasoline using their voice (CNNMoney, 2018) Acquiring new customers from the younger generation has become a challenge for the banks, a situation the FinTechs seem to be quite good at. Will FinTechs be able to help banks overcome this challenge based on their offer of services and products with greater transparency, ease, access and closeness to customers? This is a big question and some entities that have gone ahead to find answers are, in fact, already creating collaborative schemes that combine the mutual strengths. There are more and more financial entities and governments interested in approach- ing, understanding and taking advantage of the development opportunities brought forward by FinTechs. At the same time, more financial institutions are beginning to act as strategic allies of the technological innovators. Everything suggests that as the involvement of financial institutions with the Latin American FinTech ecosystem grows ―either through competition or collaboration, or a mixture of both― we will see a greater level of banking across the region and a better quality of financial products and service offerings. The above can only cause one positive thing: open individual possibilities or col- lectively, because eventually the strengthening of the financial sector will have a positive impact on the lives and economic development of each country, and then on everything, as noted by Argentine writer Jorge Luis Borges, strictly speaking, what is money but “a repertoire of possible futures”? A TWO-WAY PATH 19

Bibliography IDB, Finnovista (2017). FinTech: Innovations You Rojas. L. (2016). Innovación financiera: ¿Qué May Not Know Were from Latin America and the puede aprender la Banca Tradicional de las Caribbean. Retrieved from https://publications. FinTech? [What Traditional Banking can iadb.org/handle/11319/8265 learn from FinTech?]. Retrieved from https:// blogs.iadb.org/puntossobrelai/2017/02/16/ CNNMoney (May 22, 2018). Apple, Amazon innovacionfinanciera-puede-aprender-la-banca- y Facebook van por los servicios financieros tradicionallas-FinTech/ [Apple, Amazon and Facebook are going after Financial Services] [Expansión]. Retrieved from Ruvolo, J. (2017, April 19). Interview with Julie https://expansion.mx/tecnologia/2018/05/21/ Ruvolo. 2017 Trend Watch: Latin American apple-amazon-y-facebookvan-por-los-servicios- Venture Capital. Retrieved from https://www. financieros?internal_source=PLAYLIST finnovista.com/entrevista-julie-ruvolo-2017- trend-watch-latin-american-venture-capital/ EY (2017). EY FinTech Adoption Index 2017. Retrieved from: http://www.ey.com/Publication/ Scratch, Viacom Network (2015). Millennial vwLUAssets/ey-FinTech-adoption-index- Disruption Index. Retrieved from https:// 2017/$FILE/ey-FinTech-adoption-index-2017.pdf www.bbva.com/wp-content/uploads/2015/08/ millenials.pdf PayPal (2018). Retrieved from https://www.paypal. com/ai/webapps/mpp/about A TWO-WAY PATH 20

chapter 02FROM PAPER TO DIGITAL Gold, silver, copper, bronze, stones, seashells, tobacco, skins, coins, paper and now bits and bytes. All this has been or is money, that is, an intrinsic value implying a The Outlook is Getting Clearer… promise for reimbursement or exchange. The last 10 years have represented a pro- 1 found transformation in many of our habits and how most industries operate. Money FinTech Law is no exception. Technological advances, creativity of entrepreneurs and reductions of transaction costs, have undoubtedly been some of the key elements of this revolution in which technology and finance are mixed. The most intimate quality of money is its intangibility, its symbolic value. In ancient times it has been a seashell, nowadays an electronic record. You can not touch a dollar, a peso or any other currency like you can not touch one hour or one cubic centimeter. Money is a consensual accounting unit that measures debts or the value of what one has, but more importantly, measures confidence. About 2,300 years before the Christian era, Babylon witnessed the first letter of credit. Millennia later, technology enables new possibilities, but deep down, all unit of change is based on the exchange between two human beings that trust each other: we owe and we pay, I give you this in exchange for so many pesos. 1 In collaboration with Vicente Fenoll, Kubo Finan- Debt is money and money is debt… along the way there are many forms of transac- ciero; Francisco Mere, OOKBAL Capital; and FinTech tion and these move through established channels that we call “Banking” or through Team, White & Case Mexico. A TWO-WAY PATH 21

new avenues represented by “FinTechs”, which apply digital technologies to offer financial services. If we go through the history of humanity and financial services, at all times it has required a great trade that demands multiple knowledge, from mathematics to geo- politics and undoubtedly from anthropology and psychology, that is, the knowledge of the client and his environment. Rigorous professional practices were rooted in the world of banking precisely because money and debt are of the utmost importance for any economic activity and, therefore, could not and should not be handled by anyone. Therefore, banks are managed by professional and talented people, who are proud of having learned the importance of their contribution to society, and who face a tenacious scrutiny by regulators whose ultimate goal is protection of the public. Thus, it is not strange then that those who manage Banking are cautious, some would say even slow to operate. This is how the 21st Century found them, with a huge knowledge of his metier, of his territory, advancing with internal technology teams, but an arithmetical pace, while the world of external technology did it at exponential speed. Until well into the 21st Century - for almost a fifth of it has passed - Banking, financial services and its regulators have to fact the reality of a ‘two-speed world’. We are not living in a period of changes, but a change of time. Technology and en- trepreneurs are transforming the industry and FinTech players, regulators and any other agents involved in any activity of the value chain surrounding money know and experience it the changes on a daily basis. It is for this reason that a legal framework, a “FinTech Law” has been enacted, that places Mexico at the international vanguard. The legal order is like the initial maps of the Americas, which are without doubt im- perfect without doubt, but, at any case, navigable. So, Carpe diem! A TWO-WAY PATH 22

chapter 02 THE FINTECH LAW From the point of view of innovation, Latin America responds to this great wave of change with hundreds of entrepreneurs developing new business models, some of local creations and others are replicas of developments that happen in other regions. The emergence of accelerators or hubs of entrepreneurs, angel investors and entre- Enactment of this Law is great news, mainly preneurial capital funds, as well as the ease of accessing technologies digital, have because we already have a legal been elements of this new entrepreneurial wave in Mexico. framework for FinTechs to operate with In reality, several entrepreneurs emerged with ideas that provides proposals of value legal certainty, but above all, FinTechs may for financial services. Some of them are companies proposing to directly operate with the population (B2C), others are service initiatives that can be used by estab- commence to interact with the banking lished companies (B2B). Some more propose hybrid models, but all of them have a and financial system. Such interaction common characteristic: to innovate the traditional operating ways of “old financial intermediaries.” was not taking place at the required degree, due to the lack of legal certainty. Innovation proposes enhancements based on customers and their needs, whilst at the same time exploring solutions in the value chain of financial products in order to test whether those offers are adopted by the customer or not. Álvaro Rodríguez Arregui Founder and Managing Partner of IGNIA On March 9, 2018, Mexico took a determined step towards the future. After hard work among the Executive Branch, through the Secretaría de Hacienda y Crédito Público [Department of Treasury and Public Credit] (SHCP) and the Comisión Nacional Ban- caria y de Valores [National Banking and Securities Commission] (CNBV), the Federal A TWO-WAY PATH 23

Congress and Banco de México, with the participation of multiple entrepreneurs and the Banking industry, the Ley para Regular las Instituciones de Tecnología Financiera [Law for the Regulation of Financial Technology Institutions] (“FinTech Law”) was enacted, which was the first specialized law in the region. Like the rest of the laws of the financial sector, this law provides a framework for new activities allowed in the financial sector. The FinTech Law has as its principles the promotion of financial inclusion and com- petition, the protection of the consumer, the preservation of financial stability and the prevention of illicit operations (see figure 4). The FinTech Law covers a very broad spectrum, of which we offer some insight in terms of its main potential implications at the industry and customer level. PICTURE 4 Principles governing the FinTech Law Preservation of financial stability Financial inclusion and innovation Consumer protection Prevention of money laundry Promotion of competition Source: Dirección de Desarrollo Regulatorio [Regulatory Development Bureau], CNBV A TWO-WAY PATH 24

chapter 02 DATA BELONGS TO THE CLIENT Throughout the history of the financial system, the way Banking operates has been: “You are my client, you deposit, withdraw, pay, borrow and I give you access to bank account or Internet consultation, ATMs and SMS messages to know how you are doing, but the outcoming information of your transactions and emerging behavior patterns do not belong to you, they belong to the institution.” The financial institution may or may not use such data to create a profile of the client ‒tools to understand the client’s behavior within the competences of banking - and try to offer the client a better product or service in the future. Each bank accumulates information on individuals and businesses that operates with the bank, but for a client of two or more entities, the data is fragmented. Each one acts as if it were a different entity, circles of a financial archipelago where there are no bridges, but closed silos that do not consider the client as a whole. Data is to the economy of the 21st Century economy what oil was to the economy of the 20th Century. The right of clients to their own information is enhanced. The client has the right to go to a financial company and say: “Look, I am client of company B, I give your company my permission to contact the companies currently servicing me to know my record of withdrawals, deposits and payments, without limitation, and use such information to analyze me and see if you can offer me a product or service.” A TWO-WAY PATH 25

Such acquisition, archiving and use of data is what gives space to new opportunities, and that is what makes Mexico a pioneer, not only among the countries of its level of development, but in the world. Furthermore, the data may not only be analyzed by the bank we choose, but also the law contemplates the option to “mine data,” that is FinTechs may intervene in collaboration with a financial entity or on their own, as long as the client so decides, to study the data owned by the client and draw conclusions and suggestions based on the accumulated information. Data is to the economy of the 21st Century what oil was to the This implies that users of financial services will be able to monetize their information. Likewise, the foregoing will result in greater competition, given the benefit that the economy of the 20th Century. largest institutions have when exercising the monopoly of information, it will cease to be a barrier to entry. This concept operating through “Standardized application programming interfaces” (APIs) will be the great technological challenge for the financial sector and for new companies included in the Law. Financial institutions, FinTechs and other entities identified in the FinTech Law (money transferors, clearing houses, credit bureaus and companies authorized to transact with Completely New Models) will be forced to establish APIs that enable connectivity and access to developers possible, and in turn, by the remaining of said companies. CNBV will establish the communication protocols and data standardization that shall be observed to protect the integrity and security of the clients’ information. CNBV will authorize the exchange fees to be charged by one entity to the others for information, fees which will be reasonable and have no impact or create obstacles for competitiveness. Likewise, it should be noted that the entities accessing the clients’ information through APIs will be also subject to the terms and conditions provided in the Ley Federal de Protección de Datos Personales en Posesión de los Particulares [Federal Law for the Protection of Personal Data under Possession of Private Parties]. A TWO-WAY PATH 26

chapter 02 FINANCIAL SERVICES AND THEIR PERMANENT INNOVATION Innovation has been essential for the banks. Legend has it that one of the Rothschilds, in the Napoleon Bonaparte era, was able to enforce certain credit guarantees upon hearing of the Emperor’s failure in Waterloo by using a then state-of-the-art commu- nication technology, a carrier pigeon! Historically, leading banks have had a constant ability to innovate, demonstrated in the application of ATMs to systems of inter-bank electronic payments or wire transfers. However, it must be recognized that the financial sector, because it is highly regulated, can only carry out activities that the particular law allows and, although certain laws establish the possibility for regulators to authorize exceptions, this logic generates a comprehensible brake for technological or procedural advances arguing that “the regulation prevents us from….” Likewise, new companies with ideas that may not have been foreseen by the Law are limited by other factors such as access to capital or the cost to acquire clients. The new vision of the FinTech Law, is a logical horizon of collaboration for both existing banks and entrepreneurs of the financial system. The new framework offers the possibility of obtaining temporary authorizations. Thus, through Completely New Models, business entities that have obtained the relevant permits may carry out activities that are required to have a registration or conces- sion to carry them out, in accordance with the FinTech Law or any other financial A TWO-WAY PATH 27

law. This concept, commonly known as “regulatory sandbox”, has been an platform development engine in other jurisdictions, such as the United Kingdom. This change and the legal certainty that it provides, will favor the creation and de- velopment of new ideas in a more expeditious way, since until now many entrepre- neurs feel they have been forced to invest significant financial resources and time to adapt to the current rules, with the risk of, in the end, not obtaining the respective authorization. This will allow entrepreneurs to test if a business model is viable. The minimum viable products - MVP - will be acceptable and recordable, so that if they work the new company could operate and try to scale rapidly. A TWO-WAY PATH 28

chapter 02 The business companies that, on the effec- THE NEW FINANCIAL ACTIVITIES tive date of the FinTech Law, were already engaged in activities regulated by said Law, are to apply for a permit to the CNBV within a period of time not exceeding twelve months following effectiveness of the ap- The FinTech Law acknowledges crowdfunding and e-money institutions as financial plicable secondary regulation. Such permit, technology institutions, which have already proven to be viable and innovative. in turn, will be issued within the six months Crowdfunding Entities following effectiveness of the FinTech Law. Through new models of collective participation of people or companies, financing Such business entities may continue with for both people and small and medium enterprises may be fostered. For this, three crowdfunding models have been created: such activities while CNBV decides to grant a. them their authorization or not, provided Debt-based crowdfunding where investors grant mutual loans or other financ- ing that causes a direct or indirect liability for applicants; that such business entities publish upon b. Equity crowdfunding is intended for investors to purchase securities repre- effectiveness of the FinTech Law —on their senting the capital stock of the applicant’s business entities; and c. Revenue-based or royalty-based crowdfunding whose purpose is that investors web page or any means they use— that such and applicants enter into joint ventures or any agreement allowing the investor permit is being processed, therefore, any to acquire a distributive share or interest in a future good or in income, profits, royalties or losses arising from the applicant’s projects. such activity is not an activity supervised by the Mexican authorities. The main challenge these companies face is to rapidly reach the sufficient scale to be viable, since due to their nature they only provide “connection between projects and investors”, and may not carry out other activities; therefore, this will limit them FinTech Team, White & Case Mexico in generating income. A TWO-WAY PATH 29

It should be pointed out at this point that crowdfunding companies are not the entities acting as creditors, but only as intermediaries between applicants (borrowers) and investors (creditors). Likewise, crowdfunding companies may not carry out fundraising activities (v. gr., bank deposits) and, consequently, any investments made through them are not protected by the Instituto de Protección al Ahorro Bancario [Institute for the Protection of Bank Savings] (IPAB) or similar entities. E-money Companies In Mexico, according to the Encuesta Nacional de Inclusión Financiera [National Survey of Financial Inclusion], almost 61% of adults do not have a bank account. The financial exclusion is twice as bad because it leads to a digital exclusion when that population does not count an electronic means of payment that allows them to profit from the e-commerce advantage. The FinTech Law introduces the E-Money Institutions concept, which is similar to ‘e-money issuers’ in other jurisdictions. Through these companies users may open an account with such institutions, make wire transfers or e-payments, whether to individuals or business entities, without using the traditional system. It should be pointed out —once again— that the FinTech Law provides that such funds are not bank deposits and, consequently, are not protected by the IPAB nor bear any interest. E-money Institutions may not lend any funds, but may grant credits and loans for overdrawing, subject to the conditions provided in the FinTech Law and its secondary regulation. Cryptocurrencies History is in a hurry. What was humankind thinking about a decade ago? It was 2008 when we began talking about the concept of a coin not created by the central banks, with its control laid on cryptography and transactions were validated through mul- tiple computers. This concept, from thinker Jean Bodin has been left behind, very behind, which in the 16th Century gave rise to the theory that the State could mint coins. In the A TWO-WAY PATH 30

21st Century, with the fever caused by cryptocurrencies and the so-called Initial Coin Offering —ICO— an entrepreneur may issue a crypto-asset based on the recent technology called blockchain, to finance his company. The FinTech Law incorporates the “Virtual Asset” concept as the representation of value electronically registered, which is used by the general public as a payment method and which transfer may only be made through electronic means. In an explicit manner, it provides that these electronic transactions are not within the environment pertaining to the legal-tender currency and currencies. That is, the Law acknowledges its existence, but makes clear they are not currencies, but are always cryptocurrencies, duly identified by name. The Law allows, accordingly, that banks and regulated FinTech companies may perform transactions with virtual assets. Thus, Banco de México will determine through secondary legal provisions the virtual assets to be operated. Other financial institutions will be also able to perform transactions with virtual assets, subject to the provisions of Banco de Mexico itself. It should be noted that the Law does not allow other financial companies to operate virtual assets, and this will deprive them from the possible benefits thereof. Another development taking place in markets outside Mexico are ICOs as a mech- anism to raise capital or funds. ICOs, which in practice are tokens based on smart agreements, are not explicitly regulated by the FinTech Law, although (depending on the secondary regulation not published yet) under the concept of smart agreements may be issued through crowdfunding platforms and offered to the public and become a funding source. A TWO-WAY PATH 31

chapter 02 AMENDMENTS TO THE LEY DEL MERCADO DE VALORES [SECURITIES MARKET LAW] It is relevant to mention that, in a manner complementary to the promulgation of the FinTech Law, reforms to the Securities Market Law were promulgated in a way that explicitly exclude from the regulation of the stock market the securities that are offered through financial technology institutions. In addition, the amendment to the Securities Market Law contemplates the possibil- ity that independent investment advisors act through automated platforms, which allows the launch of investment robots or Robo-advisors. These robots may help to advance the inclusion and education of the stock market by simplifying it and making it easier to invest in the Stock Exchange. Fifteen years ago, Mexico experienced the creation of the Ley de Ahorro y Crédito Popular [Law of Popular Savings and Credit]. This Law regularized and created “tra- ditional” financial companies currently servicing more than 10 million people. The FinTech Law is demonstrating that it can challenge all participants in the value chain with a classic challenge of the computer age: achieve at least double in half the time. A TWO-WAY PATH 32

chapter 02 CONSEQUENCES OF THE FINTECH LAW FOR FINANCIAL ENTITIES Financial Institutions will require special authorization from their regulatory body to participate in the capital of the financial technology institutions, and must use personnel and promotional channels different from those of their own operations. “The financial technology institutions and Financial Entities having a share in their stock capital may agree that financial entities provide the latter with Technological Infrastructures and auxiliary services to back up the transactions of financial technology institutions, prior approval from the CNBV (in compliance with the criteria provided in the secondary regulation).” FinTech Team, White & Case Mexico It is important to mention that neither the Federal Government nor the entities of the public state administration will be able to take responsibility or guarantee the resources of the clients that are used in the operations that these celebrate with the institutions of financial technology. A TWO-WAY PATH 33

chapter THE MYTH OF “DINOSAURS” 03AND “UNICORNS” Competition vs Collaboration From the beginning of history humans seek explanations. How does Sun rise daily? Why does the night follow the day? When will it rain? Where are we most protected? If the evidence is not available, our creativity compensates and myths and legends are born. The myths and legends that we create reflect the reality we observe, but they are also loaded with our judgments, expectations and fears of cyclops and sirens. They are hybrid explanations made of truth and fiction, which also reveal important in- formation about who we are and what we think. A modern myth created by the speed and complexity of our times is comparable to the biblical story of David and Goliath; it is carried out by financial entities which, depending on their size and agility in view of the changes introduced, especially by technology, are symbolized by a dinosaur or a unicorn. “In Itaú Unibanco, we thought about Cubo because we wanted to get involved in startup ecosystems and we did not know how to do it. We used to say that we are dinosaurs wanting to talk to unicorns.” R.P.S. Gama, Cubo Manager Institutional conversation, May 28, 2018 A TWO-WAY PATH 34

The dinosaurs are the big corporations and, as a symbol, it has a double meaning. On the one hand, it communicates size and power. Dinosaurs have been the largest creatures that have inhabited the planet, dominating food chains in all geographies. So also financial corporations dominate the value chains in all industries, billing millions of dollars, serving millions of customers in different countries and capturing a high percentage of investments in the securities markets. Some have income equivalent to the GDP of entire countries: in 2014 Axa’s income was equivalent to the GDP of Finland, JP Morgan Chase’s to Colombia’s, Bank of America’s to Poland’s and Wells’ Fargo to South Africa. On the other hand, the dinosaur symbol also communicates danger of extinction. It is believed that the disappearance of the dinosaurs was due to their inability to adapt to a great disruption in the planet after an asteroid that hit the earth - which, by the way, fell in Mexico, specifically on the coast of the Yucatan Peninsula. Large banks are thought to lack the resilience required to face the technological as- teroid, due to the slowness to implement changes in its operations, the inflexibility of its processes and the aversion to risk of the decision makers. In the financial sector this apparent slowness to adapt is marked by the enormous entry barriers for new players and the strict rules with which they have to play for the sensitivity of the information and risks they manage. The unicorns, on the other hand, are those beautiful white horses with a horn in the forehead, winged and agile, capable of beating animals stronger than them. In the world of 21st century mythology, Aileen Lee - founder of the Seed Capital Fund Cowboy Ventures - began to call unicorns the technology companies that reached valuations of more than 1,000 million dollars in 2012. She noticed that only 0.07% of the companies founded in the 2000s reached that valuation, in such a way that it made them so difficult to find, like unicorns. The term has become so popular that reaching “unicorn” status has become an entre- preneur’s dream and the symbol has extended to represent all new technology-based companies seeking to reach exponential growth. A TWO-WAY PATH 35

For this study, we recorded the conversations between “dinosaurs” and “unicorns” in the Latin American financial sector. How they engage with each other when they meet, how they get to know each other a little better and how they face the question to work or not work together. Let’s start at the beginning, when the big financial institutions and FinTech startups meet and do not understand each other. They speak different languages and that translates into initial distrust. “[Some FinTechs] attack key products of the bank, those being part of the core of their business: personal loans, credit cards and current accounts.” S. Furio, founder of Creditas Institutional conversation, February 26, 2018 For their part, FinTech companies see financial corporates with a mixture of admi- ration, distrust and frustration. They admire the success and the impact they have on the industry, but they are afraid to share information about their technologies and business models with them for fear of their ideas being stolen and frustrated that they move so slowly and have to comply with so many rules. It is a dialogue that falls on deaf ears, an exchange of prejudices until the mythical animals begin to “smell” themselves in neutral spaces as innovation platforms, col- laborative events, acceleration programs, even hackathons and start looking for ways to coexist positively, how to lower the defenses, get to know each other better; then they realize that corporations are far less dinosaurs and startups are not ‘unicorn’. The myth is broken, a common language is found and the conclusion is reached that collaboration is not only possible, but urgent! A TWO-WAY PATH 36

chapter 03 A POSSIBLE SYMBIOSIS: ONE’S WEAKNESSES, OTHERS’ STRENGTHS Sometimes we think that FinTech is an island In nature it is common to find symbiotic relationships between organisms. Of these where people may satisfy their needs for relations, the most interesting are mutual societies, in which individuals of species, sometimes very different from each other, cooperate to achieve benefits for both. This financial services. However, FinTechs are, is the case between bees and flowering plants: the former carry nectar in exchange in a large portion, institutions joining the for facilitating the reproduction of the latter, carrying the pollen between their legs. banks so that the banks may offer better Financial institutions and FinTechs, in general, meet conditions to establish mutually products, a higher added value and generate beneficial symbiosis relationships: the weaknesses of some are the strengths of others. a new value offer for their clients. Hence, In the case of the former, their weakness is the speed to innovate and adapt to the the importance there exists an efficient disruptions generated by technology. It is in the banks DNA to efficiently do their job, which has led them to be successful: manage accounts and approve credits. They interaction between FinTechs and financial have a solid technological infrastructure, they are fast in keeping it updated but slow system. to take advantage of emerging technologies that offer substantial operational effi- ciencies, improve customer experience and new business opportunities. Álvaro Rodríguez Arregui “The DNA of the bank is to be a bank, to approve loans and grant loans to clients. Founder and Managing Partner, IGNIA In general, banks do not think about technology, it is not in their core.” S. Furio, founder of Creditas Institutional conversation, February 26, 2018 A TWO-WAY PATH 37

FinTechs, on the other hand, have technology at the core of their strategy, culture and operation. They build their business model based on the possibilities offered by new technologies. People with specific technological skills are a key asset of the organization, and it is the founders and managers themselves who have the expert knowledge of technology, so that decisions flow smoothly to quickly take advantage of an opportunity. For FinTechs, however, in the retail sector the acquisition of customers in this industry is very expensive. In the financial industry, trust is everything, and new companies do not have the brand or the commercial infrastructure to publicize their innovative product in the market and grow agilely in sales. “We need to create a trademark, make customer acquisition, which is not our strong point. We form alliances with financial institutions, we help them to generate the change for our service, we contribute what we know to do that maybe the financial institution does not manage to do, because it does not have the staff to do it, the ability to move faster or, otherwise, the way it works is not agile, creative and innovative.” A. Villaquirán, founder of Alkanza Institutional conversation, February 12, 2018 Financial institutions have learnt over many years of experience, are well-positioned and respected brands in the market, with a large customer base and a sophisticated and efficient commercial infrastructure. If we jump from the mythology of “dinosaurs” and “unicorns” to the metaphor of the symbiosis between bees and flowering plants, FinTechs could make the nectar of technological innovation available to large financial institutions in exchange for access to more clients to multiply their growth. Most financial institutions and FinTechs agree that this possibility exists and is desirable, as long as the conditions are in place for the relationship to prosper. A TWO-WAY PATH 38

The first step is to create a space in which empathy from both sides is achieved. The corporates must understand the motivations of the entrepreneur and the entrepreneur must understand how a financial institution works, including processes pertaining to its compliance with the rules. “By knowing the ecosystem a little bit, I think it is very important entrepreneurs have more context of Banking, the problems and challenges we face. The foregoing creates big opportunities to solve complex problems with a fresh point of view, identifying those areas where Banking could do much better.” D. Strimpopulos, director of BanregioLABS Institutional conversation, February 26, 2018 Of course, not in all cases a symbiosis is possible. FinTechs have different levels of technological impact and different motivations when competing in the industry. It is important for a corporate to understand them when they decide to open up to collaboration with startups. A TWO-WAY PATH 39

chapter 03 PROVIDERS, CHALLENGERS AND DISRUPTORS In 1996, Adam Brandenburger and Barry Nalebuff identified that the dynamics between actors in an industry were changing to adapt to a world that was growing faster and a phenomenon was being generated in which competitors cooperated to grow the market for all. This new type of interaction was called “Coopetition.” This concept invites to transcend the vision of business as a game in which the points that one loses are won by another; a zero sum game in which whoever has the most points wins. The greatest opportunities occur when players collaborate to change the rules of the game and generate a larger and more valuable market in which they can continue competing. In an industry entering this dynamic, at different moments two of the same players may see other as suppliers, buyers, competitors or strategic allies (Hamel & Prahalad, 1996). FinTechs can adopt different roles regarding financial institutions depending on their vocation, the stage of development they are in, the fit of their value proposition in the value chain of financial services and the objective of the relationship: suppliers, challengers and disruptors (see figure 5). A TWO-WAY PATH 40

PICTURE 5 BDEO Providers, challengers and disruptors Startups in the portfolio of Startupbootcamp FinTech Mexico City Spain // Provider and Startupbootcamp SCALE FinTech Mexico City Visual claim solution for the insurance industry. http://bdeo.es DAPP Mexico // Disruptor Mobile app that allows to protect bank cards and make payments without delivering the plastic cards to third parties. Provider https://dapp.mx FinTech having products and services that may be directly purchased by the DILE banks to improve their Colombia // Provider processes. Artificial intelligence and predictive analytics solution to acquire clients for financial and insurance institutions. https://dile.co Challenger Disruptor FINERIO FinTech carrying out activities FinTech introducing technol- Mexico // Disruptor competing with the banks ogies significantly changing Free Mexican platform of automated personal and using technology to offer the industry’s rules of play. finances. a more rapid and cheaper https://finerio.mx service for clients. FLINK Mexico // Challenger Source: Startupbootcamp FinTech Mexico City Online banking services solution for millennials. https://miflink.com A TWO-WAY PATH 41

QUOTANDA FRIENDLY TRANSFER Spain // Disruptor Ecuador // Disruptor Platform allowing to grant student loans through Marketplace for international wire transfers from financial institutions, universities, schools and one individual to another. governments. https://friendlytransfer.com https://quotanda.com ÜBANK KONSIGUE Chile // Disruptor Mexico // Challenger App to transform daily habits and activities into Leading crowdfactoring platform for SMEs, saving opportunities. connecting investors with companies requiring https://ubankapp.com liquidity. https://konsigue.com PAGAMOBIL MENSAJEA Mexico // Provider Ecuador // Provider Mobile app allowing the users to pay any type Transactional chat for automatization of custom- of bills, from cable, taxes to mobile phone er service, sales and marketing. top-ups. http://mensajea.net https://pagamobil.com FACTUREDO PAYIT Chile // Challenger Mexico // Disruptor Financial marketplace where payments for Mobile app to simplify payment and reception electronic invoices are made in advance, helping of payments among people you know and your companies to obtain working capital in advance. social-media contacts. https://facturedo.cl https://payit.mx EXPEDIENTE AZUL TESSERACT Mexico // Provider Mexico // Provider On boarding management and analysis-of- Company specialized in cybersecurity solutions, documents solution for financial institutions providing accessibility to cloud services at and insurance companies. a low cost. https://expedienteazul.com https://tesseract.mx A TWO-WAY PATH 42

Providers have products and services that may be directly purchased by banks to improve their processes or may even operate services for the bank by white labeling the product to improve the offering to their clients. For example, this group includes the startups using artificial intelligence (AI) to enhance the use of data generated by banks, in the case of DILE: “When you want to generate a complete transformation, you have to change many processes from the very beginning and there is where we are. For example, we tell a bank why its on-boarding is not efficient and what the bank has to transform, at the level of the different information technologies to make the bank efficient. This implies to restructure processes and technology within the organization. We make the difference with our own AI engine, making implementations on automatization tools, robotics and new programing paradigms.” E. Marín, co-founder of DILE Institutional conversation, February 12, 2018 Challengers carry out activities that compete with banks and use technology to offer a faster and cheaper service for customers. This group includes entrepreneurs who develop applications that meet the same needs as a financial institution: payments, transfers, investments or credits. “There are two types of FinTechs, the challengers and service providers. Creditas is included in the first group, since Creditas wants a piece of the cake managed by the banks. However, this does not mean they cannot collaborate. Even more, they are required to collaborate.” S. Furio, founder of Creditas Institutional conversation, February 26, 2018 Disruptors introduce technologies that seek to significantly change the industry’s rules of play, such as, for example, distributed ledger technologies, called blockchain that allow for secure transactions without the need for intermediaries. A TWO-WAY PATH 43

Providers are highly motivated to collaborate with banks because they are their clients, and banks can rely on them to streamline their processes or market intelligence, which ultimately makes them more competitive. The possibility of symbiosis is very high. The challengers can be allies and competitors at different times. In line with the dy- namics of “coopetition”, they can collaborate to develop a greater value of the entire market by introducing better processes and relationship models, and then compete for clients, giving each one its best experience and price. Disruptors move into lesser-known lands and financial institutions see them as longer-term bets. They can become suppliers to improve processes or perhaps the transformation they propose is so profound that whole new business models could emerge. The new myth, the new legend that will be written for the financial ecosystem, is not the disappearance of some and the flight of others, but the symbiosis between the FinTechs and the financial institutions that may have different levels of intensity. In the next chapter we discuss the disruptors in more detail. A TWO-WAY PATH 44

Bibliography Brandenburger, A.M. & B.J. Nalebuff (1996). Hamel, G. & C.K. Prahalad (1996). Competing for Coopetition: A Revolution Mindset that Combines the future. Harvard Businness School. Competition and Cooperation. Crown Business. Prats, M.J., J. Siota, T. Canonici & X. Contijoch (May, CNNMoney (May 22, 2018). Apple, Amazon y 2018). Open Innovation. Building, Scaling and Facebook van por los servicios financieros Consolidating Your Firm’s Corporate Venturing [Expansión]. Retreived from https:// Unit. IESE Business School, Opinno. expansion.mx/tecnologia/2018/05/21/apple- amazon-y-facebookvan-por-los-servicios- financieros?internal_source=PLAYLIST Interview Interview with Ricardo Arenas, CEO of Tesseract, Interview with Reynaldo Pestana Saldanha and Francisco Illescas, Chief Marketing Officer. Gama, manager of Cubo. Mexico City: IPADE, Mexico City: IPADE, February 22, 2018 March 28, 2018 Interview with Sergio Furio, founder of Creditas. Interview with Demetrio Strimpopulos, Mexico City: IPADE, February 26, 2018 BanregioLABS’s director. Mexico City: IPADE, February 26, 2018 Interview with Esteban Marín, co-founder of Dile. Mexico City: IPADE, February 12, 2018 Interview with Andrés Villaquirán, founder of Alkanza. Mexico City: IPADE, February 12, 2018 A TWO-WAY PATH 45

chapter FROM DISRUPTION 04TO OPEN INNOVATION Cooperation Models At the end of the 1990s, Clayton Christensen, a business professor at Harvard, observed beyond Capital Investment how the emergence of new technologies was accelerating the innovation cycles of industries and putting in check successful companies that lost market leadership to new competitors more small, but more agile. He called this phenomenon “disruptive innovation” (1997). Like any successful concept that jumps from the academy into the public domain, after a while, his began to distort to the point of naming “disruption” to any transfor- mation that seems radical. However, the concept has some subtleties that Christensen insisted on endorsing years later in the pages of the Harvard Business Review (2015). We are interested in the present study to explore the benefits of collaboration between large corporations and entrepreneurs. A leading company in its market, the professor recalls, aims to maintain a high level of sales of the products or services that make it successful and for that it focuses on continuously improving its offer. This is the process of sustained innovation: im- proving the performance of the attributes most valued by their current customers. All the DNA of a large company is aligned to meet that goal. A TWO-WAY PATH 46

In mature industries there are potential consumers in the lower part of the market who require the product or service, but not as sophisticated as those offered by leading brands; there are also customers who do not consume it either because the current offer does not address those attributes in which they find value. Disruption occurs when an entrepreneur, supported by some technology, new or not, generates a business model that allows these customers to be profitably served or to encourage the consumption of those who were previously not considered potential buyers. With this, this model begins to prosper gradually until it is in a position to challenge the traditionally dominant companies in the market. This usually happens outside the radar of the leading companies that are concen- trated in the present segments of greater value and for which, even if they wanted to react and address this disruption, it would imply going against their own DNA: their culture, their vocation, their resources, the skills of its people, its processes, its profitability formula. What can a leading company, such as large financial entities, do to identify and act in the face of the disruptions generated by technology? The first thing is to be willing to open your innovation model. It is increasingly difficult to innovate only with ideas that are generated within the company, there is so much happening outside! Henry Chesbrough (2003), a professor at Haas Business School at UC Berkeley, defined “open innovation” as the paradigm that assumes that companies can and will use both external and internal ideas to accelerate their innovation. When Chesbrough wrote about open innovation, the collaboration between the com- pany and the academy was talked about, in view of successful models such as the Stanford Research Institute - now SRI International - which develops technology and produces business applications based on academic research. For example, Siri, the famous virtual assistant on Apple devices, emerged from a spin-off of SRI from research in Artificial Intelligence (AI) that Apple ended up buying to incorporate it into its products. A TWO-WAY PATH 47

In recent years we have begun to talk more about the collaboration between large corporations directly with startups that are addressing potential disruptive innova- tions in the industries in which they participate. Compilations of best practice for collaboration between corporates and startups have begun, such as the one done by IESE Business School and Opinno in May 2018 (Prats, Siota, Canonici & Contijoch) and Nesta, Founders Intelligence and startups Europe in 2015 (Mocker, Bielli & Haley, 2015). The protagonists of this study, on both sides of the value equation, dinosaurs and unicorns, are witnessing collaboration formats that have worked in the financial industry in Latin America and the benefits obtained by this type of open innovation to address the disruptions. A TWO-WAY PATH 48

chapter 04 INNOVATION “POWERED BY STARTUPS” The first reaction that large corporates have when they open themselves to the possibility of innovating through startups is to seek capital investment (corporate venturing) or directly go shopping (acquisitions). Although in many cases this types of model has been successful, it is an expensive option and there are high risks for failed integration due to the incompatibility of each organization’s DNA or because the short-term profitability demands of corporates end up undermining the innovation of entrepreneurs. “The bank’s strategy was firstly to step into the entrepreneurship through funds. Then, in Mexico, the bank invested in four innovations; this was the first innova- tion. Thereafter, when we worked with a startup, we assess the most proper type of relationship on a case-by-case basis.” D. Strimpopulos, director of BanregioLABS Institutional conversation, February 26, 2018 Christensen warns in the presentation of his theory of disruptive innovation that we must plant the seeds of the new business models at a healthy distance from the operation of the company: neither very close to its current profitability logic, nor too far from the proposal of value to the business. A TWO-WAY PATH 49

The sample of financial institutions that make up this study agree on two things: to be very clear about the objective of what you want to achieve from the link with entrepreneurs and to propose a collaboration model that allows you to explore com- patibility on a case-by-case basis before making more commitments. deep. Three types of objectives can be identified by which a financial institution approaches a FinTech: First. To create a different culture among the people who work in the company, ex- posing them to the new ideas of the entrepreneurs and accompanying this process with multidisciplinary teams that complement with different visions. “We wanted to create a team understanding a different way to do things, a multi- disciplinary team emphasizing design, humanity, behavioral economy, sociology and anthropology.” D. Strimpopulos, director of BanregioLABS Institutional conversation, February 26, 2018 Second. To solve internal business challenges through technological solutions in which entrepreneurs specialize, such as better security processes contributed by Tesseract, the video-inspection for insurers offered by BDEO or the mitigation of the fraud that obtains the IA of DILE. Third. To explore and enter new market niches, which are particularly attractive when technologies create new paradigms such as smart contracts offered by RSK using blockchain or automated financial advice, robo-advisory, facilitated by Alkanza. Once the objective to be achieved in collaboration with FinTechs is clear, financial institutions have to propose the best collaboration model to approach the entrepreneur with respect and help them to develop, looking for a mutual future benefit. A TWO-WAY PATH 50

“There is no unique answer to the liaison model, as it depends of each business model by each FinTech and the liaison model defined by each bank: we can prepare pilots or concept tests or even become technology partners in a commercial manner.” J. C. Espinosa, director of Digital Strategy and Innovation of HSBC Mexico Institutional conversation, March 5, 2018 Practically all financial institutions have addressed a three-step process: scouting or search, pilot or validation, and implementation. According to latest figures from Finnovista published in June 2018, there are more than 1,100 FinTechs present in the region, with annual growth rates of around 50% in the main markets (Finnovista, 2018). Different financial institutions have created a vehicle or partnership with another organization to identify interesting startups and attract them to work with them. This vehicle can take different forms depending on the level of involvement that the financial institution intends, the cost, the risk, the stage of development of the startup, the implementation time and the cultural, media and commercial impact (see figure 6). Beyond CVC (corporate venture capital) investments and acquisitions (M&A), the ve- hicles that are being explored the most are startup skills, incubation and acceleration programs, and commercial pilots. Banregio, Gentera, HSBC Mexico and Visa, for example, decided to partner with external partners, such as Startupbootcamp FinTech: an initiative that, with a prov- en coupling model, has deployed specific acceleration programs for the financial industry in three different continents in the last four years. In turn, Visa launched, with Finnovista, the Visa Everywhere Initiative for Latin America and the Caribbean, to call on entrepreneurs to explore solutions that solve the challenges of future trade and define the future of financial services in the region. A TWO-WAY PATH 51

PICTURE 6 Different open-innovation mechanisms deployed by financial entities Initiative Corporate Cultural Impact Exposition Startup Stage Term for Commercial Strategic Fit Risk Cost Involvement to Media implementation Impact Startup 2 Medium / Medium Seed / Short Term Low 4 Low Low Competitions High Pre-seed Low / Limited High Commercial Pilot 5 Medium (only study Series A Short Term (short and 10 Low Medium cases) long term) CVC Investment 7 Limited / Medium / Series A - D Short Term Low / High 7 High High None High Mergers 8 Limited / Medium / Series C + Short Term Medium 9 Medium High & Acquisitions None High Internal Incubator 10 Depending No N/A Medium Term Low 7 Medium Medium on training Traditional R+D 10 Limited / No N/A Long Term Low / High 7 High High None Source: Finnovista A TWO-WAY PATH 52

Banregio and Gentera launched BanregioLABS and Fiinlab respectively, their own open innovation initiatives and commercial pilot programs, where they do their own scouting and invite FinTechs to work on projects with them. The difference between these Labs is that they also promote intrapreneurship in a flexible and independent scheme. Itaú opted for an association to launch a completely open platform, Cubo, which collects information on startups exclusively with B2B value propositions and which anyone, including its competitors, can consult. It works thanks to the incentive that everyone can find information about everyone. “We learn from the relationship between the bank and entrepreneurs. Since this is a non-exclusive open platform, startups may trade with Itaú and any other bank and company of any other segment; we do not apply this restriction, which adds value by not limiting the entrepreneur.” R. P. Saldanha Gama, manager of Cubo Institutional conversation, March 28, 2018 Once they filter and choose the FinTechs with which they want to work, the process of mutual knowledge begins. Some institutions offer an acceleration process with mentors, close support and access to resources; others go directly to create pilots for very specific challenges from within the organization, with the ultimate goal of finding an ideal model in which both the corporate and the startup succeed. “Instead of developing software from the very beginning, what we did was a liaison model with this company that enables us to offer to our clients the app ‘HSCB Control Total’ in a white label model, where the app, name and branding are owned by HSBC through a technology partnership.” J. C. Espinosa, director of Digital Strategy and Innovation of HSBC Mexico Institutional conversation, March 5, 2018 A TWO-WAY PATH 53

chapter 04 GO-TO-MARKET «POWERED BY CORPORATIONS» The key to achieving a symbiosis of mutual benefit between corporate and startups, is that the linking vehicle allows the latter to take advantage of the infrastructure and market access of the former to grow. We found three ways in which financial institutions help FinTechs accelerate their arrival in the market. First. Offering shared services such as regulation, marketing, design and development, as Fiinlab does, which frees up time and resources for entrepreneurs to concentrate on the higher-value technological activities they offer and speed up the commer- cialization of their offer. Second. Giving access to its data infrastructure or its technology platforms to de- velop joint solutions. Visa, for example, launched the Visa Developer Center website, where any FinTech entrepreneur can explore the 200 Application Programming (API) interfaces and the 30 solutions that can help leverage your projects. A TWO-WAY PATH 54