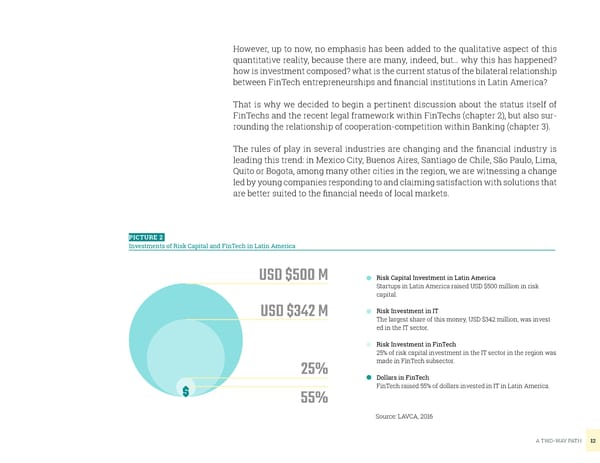

However, up to now, no emphasis has been added to the qualitative aspect of this quantitative reality, because there are many, indeed, but… why this has happened? how is investment composed? what is the current status of the bilateral relationship between FinTech entrepreneurships and financial institutions in Latin America? That is why we decided to begin a pertinent discussion about the status itself of FinTechs and the recent legal framework within FinTechs (chapter 2), but also sur- rounding the relationship of cooperation-competition within Banking (chapter 3). The rules of play in several industries are changing and the financial industry is leading this trend: in Mexico City, Buenos Aires, Santiago de Chile, São Paulo, Lima, Quito or Bogota, among many other cities in the region, we are witnessing a change led by young companies responding to and claiming satisfaction with solutions that are better suited to the financial needs of local markets. PICTURE 2 Investments of Risk Capital and FinTech in Latin America USD $500 M Risk Capital Investment in Latin America Startups in Latin America raised USD $500 million in risk capital. USD $342 M Risk Investment in IT The largest share of this money, USD $342 million, was invest- ed in the IT sector. Risk Investment in FinTech 25% of risk capital investment in the IT sector in the region was 25% made in FinTech subsector. Dollars in FinTech 55% FinTech raised 55% of dollars invested in IT in Latin America. Source: LAVCA, 2016 A TWO-WAY PATH 12

Fintech in LATAM | EY | Startupbootcamp FinTech | IPADE Page 11 Page 13

Fintech in LATAM | EY | Startupbootcamp FinTech | IPADE Page 11 Page 13