PwC & Startupbootcamp InsurTech: READY FOR TAKE OFF

How InsurTechs are poised to transform insurance

READY FOR TAKE OFF How InsurTechs are poised to transform insurance

02 Contents 03 05 13 30 Executive The InsurTech Trends in Enabling summary landscape in 2017 InsurTech collaboration 37 40 41 42 What next for Conclusion A closing note Contact InsurTech? from Sabine

03 Executive summary PwC’s second year of collaboration with the Startupbootcamp InsurTech looking to combine a number of different external propositions, along with program takes place against a backdrop of growing excitement, invest- their own capabilities, to deliver more powerful propositions. ment and a rapidly increasing number of new businesses and collaborative partnerships. The growth of InsurTech has been remarkable, with a thriv- With the ecosystem maturing, the stage is set for InsurTech to begin deliv- ing ecosystem of start-ups, insurers, investors and innovators springing up ering significant value, which has the potential to change insurance for the over the past twelve months. greater good of both customers and the industry as a whole. InsurTech has opened a fantastic window of opportunity. Notably, this year, we are witnessing start-ups emerge with more sophisti- cated and wide-ranging value propositions that augment and supplement But it is important not to get carried away. InsurTech will not transform the entire insurance value chain. This is a step away from the skewed focus the bottom line overnight and it will not all be plain sailing. Maturing start- on distribution that was initially the case when InsurTech exploded onto ups will need time to prove their value in an industry where KPIs such as the scene. claims ratios can take time to be realised, insurers need to transform how they work and these collaborative models will take time to embed. And, of It is not just the start-ups that are reaching maturity, so is the InsurTech course, not every start-up will succeed. ecosystem as a whole. Last year’s report highlighted the importance of collaboration between start-ups, insurers and others to deliver value for Nevertheless, InsurTech is a movement on the verge of a breakthrough. customers and the bottom line because InsurTech offerings were primarily Insurers understand that InsurTechs can help them grow revenue, launch enabling rather than disruptive. This remains the case and it seems as if the innovative propositions, reduce costs and transform their relationships battle for hearts and minds has now been won - insurers are increasingly with customers for the better. As those hopes are realised, the growth of looking outwards to innovate and their engagement with start-ups is more InsurTech could become exponential. positive and advanced. The position of Startupbootcamp and PwC at the centre of the InsurTech This can be seen in the increasing number of proof of concepts (PoCs) ecosystem offers a unique view of its rapid progress. In this report, we will that are being carried out as well as their increasing complexity. No longer share our insight, the trends we see and explore how collaboration be- are start-ups seen as point solutions, for example, many insurers are now tween InsurTechs and insurers can drive value in the future.

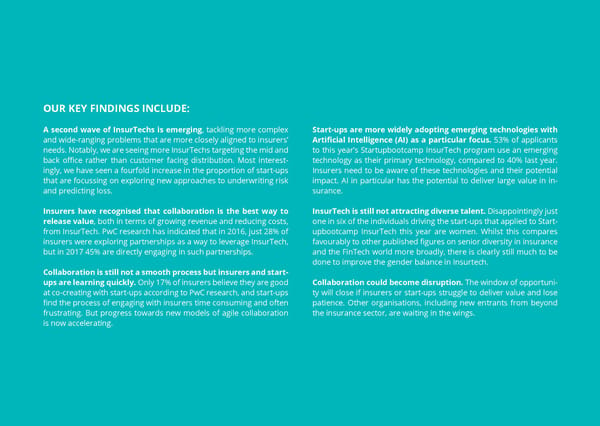

4 OUR KEY FINDINGS INCLUDE: A second wave of InsurTechs is emerging, tackling more complex Start-ups are more widely adopting emerging technologies with and wide-ranging problems that are more closely aligned to insurers’ Artificial Intelligence (AI) as a particular focus. 53% of applicants needs. Notably, we are seeing more InsurTechs targeting the mid and to this year’s Startupbootcamp InsurTech program use an emerging back office rather than customer facing distribution. Most interest- technology as their primary technology, compared to 40% last year. ingly, we have seen a fourfold increase in the proportion of start-ups Insurers need to be aware of these technologies and their potential that are focussing on exploring new approaches to underwriting risk impact. AI in particular has the potential to deliver large value in in- and predicting loss. surance. Insurers have recognised that collaboration is the best way to InsurTech is still not attracting diverse talent. Disappointingly just release value, both in terms of growing revenue and reducing costs, one in six of the individuals driving the start-ups that applied to Start- from InsurTech. PwC research has indicated that in 2016, just 28% of upbootcamp InsurTech this year are women. Whilst this compares insurers were exploring partnerships as a way to leverage InsurTech, favourably to other published figures on senior diversity in insurance but in 2017 45% are directly engaging in such partnerships. and the FinTech world more broadly, there is clearly still much to be done to improve the gender balance in Insurtech. Collaboration is still not a smooth process but insurers and start- ups are learning quickly. Only 17% of insurers believe they are good Collaboration could become disruption. The window of opportuni- at co-creating with start-ups according to PwC research, and start-ups ty will close if insurers or start-ups struggle to deliver value and lose find the process of engaging with insurers time consuming and often patience. Other organisations, including new entrants from beyond frustrating. But progress towards new models of agile collaboration the insurance sector, are waiting in the wings. is now accelerating. 04

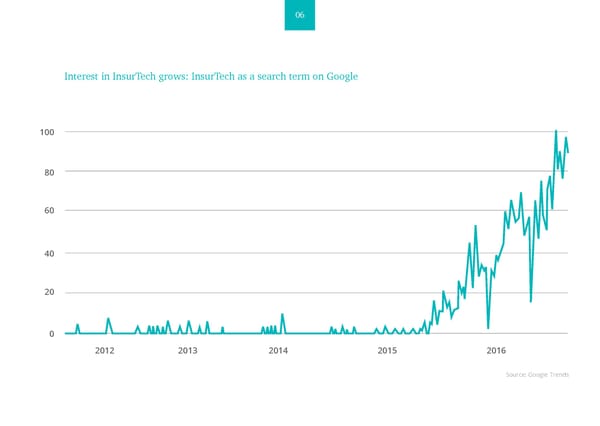

05 1. The InsurTech Landscape in 2017 KEY TAKEAWAYS FROM THIS CHAPTER: InsurTech is continuing to build momentum, with deals in the sector increasing Insurers are excited about the prospect of working with InsurTechs, giving the sector a window of opportunity to prove its value This is set against the backdrop of an insurance industry facing numerous challenges and a world undergoing rapid change InsurTech continues to mature. Since last year’s Startupbootcamp In- surTech trend report highlighted the growing “mainstream awareness” of InsurTech, excitement around the sector has grown further. You need look no further than this year’s Startupbootcamp InsurTech demo day at the O2 Arena in London where more than 850 delegates packed the ven- ue and over 6,000 watched it streamed live on Facebook. The excitement is highlighted by the prevalence of “InsurTech” as a Goo- gle search term which has increased exponentially from virtually nothing at the end of 2015. 05

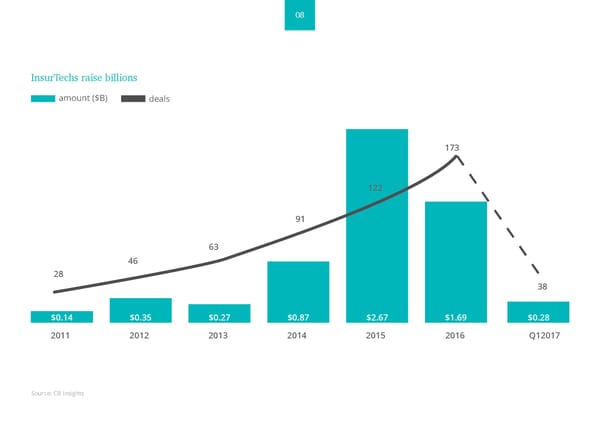

07 Amid the buzz, InsurTech businesses have themselves begun to grow up, at- Despite the general upward trend, investment in Q1 2017 was disappoint- tracting interest from both traditional insurers and an audience beyond the ing, according to data from CB Insights and Willis Towers Watson, and down insurance industry. “InsurTech is no longer the new kid on the block,” says Ori on the same quarter in the previous year by a significant $500m - although Hanani from the insurer Admiral’s French operation. only down by $20m when solely early stage investments are considered. It is too early to say whether this trend will continue but some commentators An often cited example is Lemonade, the US technology-driven property are now noting that investment isn’t matching the hype. and casualty insurance company, which has been hitting the headlines this year - it grabbed particular attention after settling a claim in a world record However, there is certainly money out there. Multiple corporate venture 3 seconds. And there are examples closer to home such as Startupboot- capitalists and funds have targeted the InsurTech space and announced camp alumni Buzzmove, which has raised £6m of investment since leaving large sums to invest. At the time of writing, for example, QBE recently an- the accelerator last year and launched buzzVault, a new service aimed at nounced a plan to invest $50 million into InsurTech, WR Berkley created a customers who want to “protect, manage and store” their belongings in a new role focussed solely on InsurTech investment and IA Capital Group are “digital vault”. looking to insurers to build a $100 million InsurTech war chest. Offerings such as these are attracting the significant amounts of funding The low investment figures in Q1 of this year may be a symptom of In- now flowing into InsurTech businesses. Indeed, the flow of capital into In- surTech’s youth. With two thirds of deals at seed or series A level in 2016 surTech underlines its growing significance and perceived future value. there simply aren’t enough InsurTechs of scale (yet) to send investment 1 dollars higher. There just aren’t that many later stage start-ups raising the In 2016, we saw more deals in the InsurTech sector than ever before, larger sums to do so. As some of those early stage investments begin to with 173 separate transactions according to CB Insights, a 42% increase on find their feet it is possible that we will start to see significant deals more the previous year. And as Figure 1 reveals $1.69bn was invested into In- regularly. It may also be that those looking to invest are conscious of the surTech start-ups during 2016, the second year running in which these com- buzz around InsurTech, wary of inflated prices, and are resultantly biding panies attracted more than $1bn of investment. While that was lower than their time. the record $2.67bn of investment seen in 2015, that figure included some unusually large individual transactions, including investments of $931m in Zhong An, the Chinese full-stack insurer, and $500m in Zenefits. 1 CB Insights analysis

07 Amid the buzz, InsurTech businesses have themselves begun to grow up, at-Despite the general upward trend, investment in Q1 2017 was disappoint- tracting interest from both traditional insurers and an audience beyond the ing, according to data from CB Insights and Willis Towers Watson, and down insurance industry. “InsurTech is no longer the new kid on the block,” says Orion the same quarter in the previous year by a signiicant $500m - although Hanani from the insurer Admiral’s French operation. only down by $20m when solely early stage investments are considered. It is too early to say whether this trend will continue but some commentators are now noting that investment isn’t matching the hype. An often cited example is Lemonade, the US technology-driven property and casualty insurance company, which has been hitting the headlines this year - it grabbed particular attention after settling a claim in a world record However, there is certainly money out there. Multiple corporate venture capitalists and funds have targeted the InsurTech space and announced 3 seconds. And there are examples closer to home such as Startupboot- camp alumni Buzzmove, which has raised £6m of investment since leaving large sums to invest. At the time of writing, for example, QBE recently an- nounced a plan to invest $50 million into InsurTech, WR Berkley created a the accelerator last year and launched buzzVault, a new service aimed at new role focussed solely on InsurTech investment and IA Capital Group are customers who want to “protect, manage and store” their belongings in a “digital vault”. looking to insurers to build a $100 million InsurTech war chest. Oferings such as these are attracting the signiicant amounts of funding The low investment igures in Q1 of this year may be a symptom of In- now lowing into InsurTech businesses. Indeed, the low of capital into In-surTech’s youth. With two thirds of deals at seed or series A level in 2016 surTech underlines its growing signiicance and perceived future value.there simply aren’t enough InsurTechs of scale (yet) to send investment dollars higher.1 There just aren’t that many later stage start-ups raising the In 2016, we saw more deals in the InsurTech sector than ever before, larger sums to do so. As some of those early stage investments begin to with 173 separate transactions according to CB Insights, a 42% increase on ind their feet it is possible that we will start to see signiicant deals more the previous year. And as Figure 1 reveals $1.69bn was invested into In- regularly. It may also be that those looking to invest are conscious of the surTech start-ups during 2016, the second year running in which these com-buzz around InsurTech, wary of inlated prices, and are resultantly biding panies attracted more than $1bn of investment. While that was lower than their time. the record $2.67bn of investment seen in 2015, that igure included some unusually large individual transactions, including investments of $931m in Zhong An, the Chinese full-stack insurer, and $500m in Zeneits. 1 CB Insights analysis

08 InsurTechs raise billions amount ($B) deals 173 122 91 63 46 28 38 $0.14 $0.35 $0.27 $0.87 $2.67 $1.69 $0.28 2011 2012 2013 2014 2015 2016 Q12017 Source: CB Insights

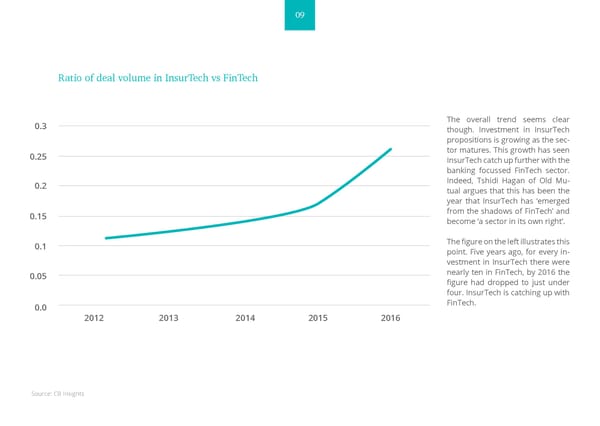

09 Ratio of deal volume in InsurTech vs FinTech 0.3 The overall trend seems clear though. Investment in InsurTech propositions is growing as the sec- 0.25 tor matures. This growth has seen InsurTech catch up further with the banking focussed FinTech sector. 0.2 Indeed, Tshidi Hagan of Old Mu- tual argues that this has been the year that InsurTech has ‘emerged 0.15 from the shadows of FinTech’ and become ‘a sector in its own right’. 0.1 The figure on the left illustrates this point. Five years ago, for every in- vestment in InsurTech there were 0.05 nearly ten in FinTech, by 2016 the figure had dropped to just under four. InsurTech is catching up with 0.0 FinTech. 2012 2013 2014 2015 2016 Source: CB Insights

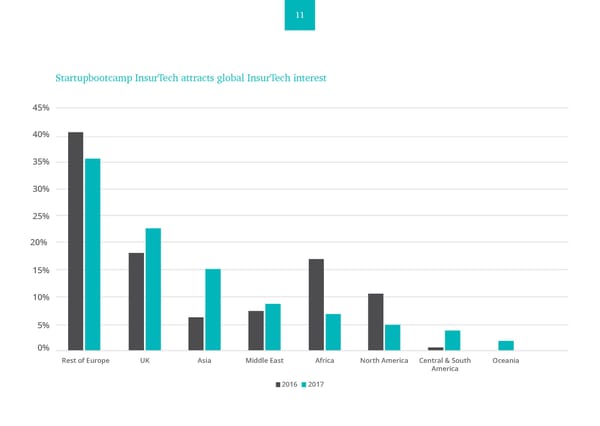

10 Startupbootcamp InsurTech’s own experience provides further evidence This is because “we are only now starting to see the types of businesses that the InsurTech sector is growing rapidly. Applications to the Startup- coming through that will have a big impact in the world of insurance” Dan bootcamp InsurTech program have almost doubled since last year, with an Smith of Exponential points out, “many are completing PoCs right now; it increasingly diverse and global range of businesses seeking support and won’t be long until they start delivering significant value”. acceleration. There was an even more international flavour to this year’s applications, including the first applications from Oceania (see Figure on There are already success stories. Take RightIndem, a member of 2016’s the next page). InsurTech is now a truly global phenomenon. Startupbootcamp InsurTech cohort. Its customer-centric claims software offers greater control to policyholders, speeds up resolution of claims Insurers themselves have become very active in the investment space de- and improves claims centre productivity for insurers. The company is now spite a pretty sluggish start. In 2012, just one insurer or reinsurer agreed working with six separate insurers, having completed several PoCs, and has a deal with a technology-focussed business, according to CB Insights; last an impressive global pipeline. year, that figure was 100. Startupbootcamp InsurTech’s own portfolio of partners (18 in total, encompassing 26 different brands) provides further evidence of the desire of the mainstream insurance industry not only to invest in but to forge partnerships with emerging InsurTechs too. We are only now starting to see the types of businesses coming through that will have a big impact in the world of insurance. Many are completing PoCs right now; it won’t be long until they start delivering significant value. Dan Smith, Exponential

11 Startupbootcamp InsurTech attracts global InsurTech interest 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% Rest of Europe UK Asia Middle East Africa North America Central & South Oceania America 2016 2017

12 The economic backdrop The Brexit effect The InsurTech phenomenon comes at an opportune moment for the in- The UK’s departure from the European Union represents a challenge for surance industry. It is an industry that is facing many challenges including: InsurTech businesses, just as it will impact the wider insurance and fi- nancial services (FS) industry. While London is likely to remain a world-re- • low interest rate and low growth economies, nowned insurance centre, Brexit could undermine its pre-eminence – and • changing and challenging regulation, the uncertainty during the negotiation period is potentially destabilising. • the restrictions of legacy systems and processes, • significant changes in customer behaviours and expectations, In the short term, Brexit has had limited effect – applications to Startup- • poor customer perceptions bootcamp from InsurTech businesses based in other European Union countries actually rose this year, a phenomenon also seen in the FinTech But as Jonathan Howe, Global InsurTech Lead at PwC, wrote recently “this program. Still, the long-term impact remains difficult to predict and there is not an industry in inevitable decline. There is a clear social need for are certainly question marks as to whether talent and investment will still insurance, and the emergence of new risks in a changing world means be drawn to British shores to the same degree that they are currently. there is more need than ever before for individuals and businesses to protect themselves.” InsurTech offers insurers the opportunity to rein- That said, InsurTechs should also recognise that Brexit may offer oppor- vent themselves and meet their challenges head on. tunities, such as the potential relaxing of regulations in order to stimulate innovation. And if insurers, regulators and government are able to work together to continue to allow cross border insurance services post Brexit, there is no reason to think London will not remain an important hub for InsurTech. This is not an industry in inevitable decline. There is a clear social need for insurance, and the emergence of new risks in a changing world means there is more need than ever before for individuals and businesses to protect themselves. Jonathan Howe, PwC

13 2. Trends in InsurTech KEY TAKEAWAYS FROM THIS CHAPTER: Increasingly sophisticated start-ups are offering greater value, tackling more complex problems through- out the insurance value chain and not only in personal lines Emerging technologies such as AI are increasingly important to the In- surTech sector Collaboration between insurers and InsurTechs remains vital to maxi- mising value; increasing numbers of insurers recognise that, but some must do more

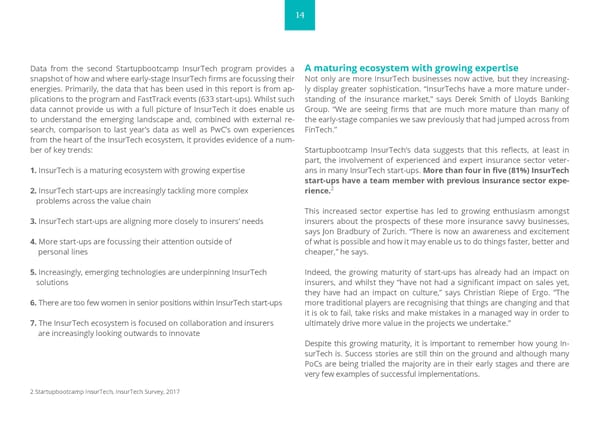

14 Data from the second Startupbootcamp InsurTech program provides a A maturing ecosystem with growing expertise snapshot of how and where early-stage InsurTech firms are focussing their Not only are more InsurTech businesses now active, but they increasing- energies. Primarily, the data that has been used in this report is from ap- ly display greater sophistication. “InsurTechs have a more mature under- plications to the program and FastTrack events (633 start-ups). Whilst such standing of the insurance market,” says Derek Smith of Lloyds Banking data cannot provide us with a full picture of InsurTech it does enable us Group. “We are seeing firms that are much more mature than many of to understand the emerging landscape and, combined with external re- the early-stage companies we saw previously that had jumped across from search, comparison to last year’s data as well as PwC’s own experiences FinTech.” from the heart of the InsurTech ecosystem, it provides evidence of a num- ber of key trends: Startupbootcamp InsurTech’s data suggests that this reflects, at least in part, the involvement of experienced and expert insurance sector veter- 1. InsurTech is a maturing ecosystem with growing expertise ans in many InsurTech start-ups. More than four in five (81%) InsurTech start-ups have a team member with previous insurance sector expe- 2. InsurTech start-ups are increasingly tackling more complex rience.2 problems across the value chain This increased sector expertise has led to growing enthusiasm amongst 3. InsurTech start-ups are aligning more closely to insurers’ needs insurers about the prospects of these more insurance savvy businesses, says Jon Bradbury of Zurich. “There is now an awareness and excitement 4. More start-ups are focussing their attention outside of of what is possible and how it may enable us to do things faster, better and personal lines cheaper,” he says. 5. Increasingly, emerging technologies are underpinning InsurTech Indeed, the growing maturity of start-ups has already had an impact on solutions insurers, and whilst they “have not had a significant impact on sales yet, they have had an impact on culture,” says Christian Riepe of Ergo. “The 6. There are too few women in senior positions within InsurTech start-ups more traditional players are recognising that things are changing and that it is ok to fail, take risks and make mistakes in a managed way in order to 7. The InsurTech ecosystem is focused on collaboration and insurers ultimately drive more value in the projects we undertake.” are increasingly looking outwards to innovate Despite this growing maturity, it is important to remember how young In- surTech is. Success stories are still thin on the ground and although many PoCs are being trialled the majority are in their early stages and there are very few examples of successful implementations. 2 Startupbootcamp InsurTech, InsurTech Survey, 2017

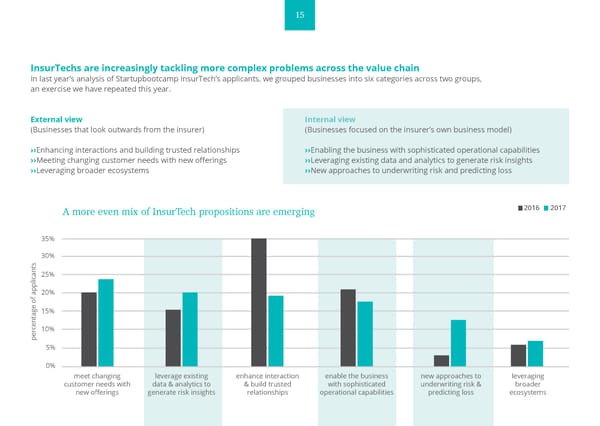

15 InsurTechs are increasingly tackling more complex problems across the value chain In last year’s analysis of Startupbootcamp InsurTech’s applicants, we grouped businesses into six categories across two groups, an exercise we have repeated this year. External view Internal view (Businesses that look outwards from the insurer) (Businesses focused on the insurer’s own business model) ››Enhancing interactions and building trusted relationships ››Enabling the business with sophisticated operational capabilities ››Meeting changing customer needs with new offerings ››Leveraging existing data and analytics to generate risk insights ››Leveraging broader ecosystems ››New approaches to underwriting risk and predicting loss A more even mix of InsurTech propositions are emerging 2016 2017 35% 30% 25% 20% 15% 10% percentage of applicants 5% 0% meet changing leverage existing enhance interaction enable the business new approaches to leveraging customer needs with data & analytics to & build trusted with sophisticated underwriting risk & broader new offerings generate risk insights relationships operational capabilities predicting loss ecosystems

16 A comparison between last year’s applicants and this year’s shows that tomers purchasing insurance. In many ways this was the low-hanging fruit, whilst 61% of applicants last year had an external focus, primarily distri- insurance is perceived to be lacking in its engagement with customers. By con- bution and customer interaction propositions, this year the figure had trast, this category was only the third largest in 2017; while such solutions have dropped to just 50%. This underlines the increasing diversity of InsurTechs a great deal to offer, the decrease in their prevalence is again suggestive of the and their growing application across the value chain and in particular to the fact that we are seeing more complex insurance-specific solutions emerging. back and mid office. This is not to say that there is less focus on the customer. The decrease is only relative to last year’s applications and back end solutions can also benefit cus- Notably, there has been a significant increase in the number of InsurTechs tomers by making insurers more efficient enabling lower prices to customers, focussed on underwriting solutions, indicative of the increasingly complex, for example. insurance-specific problems now being tackled. As Peter Klingspor of Ta- lanx notes, this reflects how “the range of problems that InsurTechs are Excitingly, this year’s largest group of start-ups were those that seek to addressing has broadened over the course of the year, from a focus on the “meet changing customer needs with new offerings”. Such solutions are front end to truly tackling the entire insurance value chain”. designed to make insurance more relevant and trusted, and often offer insur- ers an opportunity to engage with segments of the market with which they More specifically, amongst last year’s applicants, firms that aim to “enhance have traditionally struggled to build relationships. As well as this, insurers will interaction and build trusted relationships” dominated. These start-ups were be able to diversify and differentiate, targeting more niche customer segments typically focussed on distribution, offering a dynamic new front-end for cus- or developing more niche solutions.

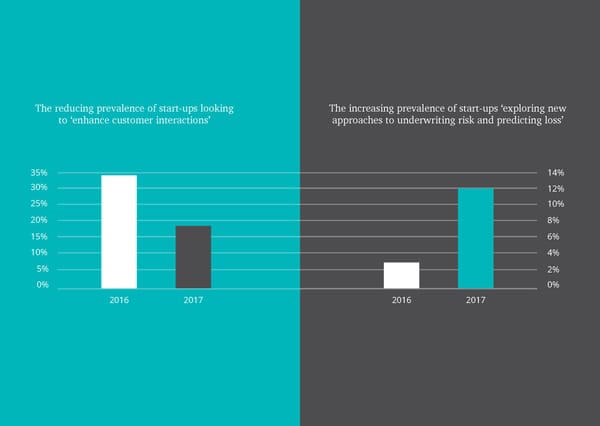

17 Such solutions are exemplified by companies like TikkR, a member of the 2017 Start-ups ‘exploring new approaches to underwriting risk and predicting loss’ cohort. It operates an on-demand digital insurance platform that can insure was the fastest growing category, with a fourfold increase from last year. One people’s ‘active moments’, such as insuring a surfer when they are surfing, example in this instance is firms looking to help insurers better understand removing the need for multiple long-term contracts; TikkR’s ultimate goal is to and price cyber risk. One applicant to the program, Cybewrite, is creating a analyse customers’ lifestyles in order to predict and protect their ‘moments’ platform to help insurers do just that. This is significant as it is clear evidence automatically. Another good example in this category is Sharenjoy, which of- that InsurTechs are increasingly moving through the value chain and solving fers one of the world’s first experiential insurance for millennials who enjoy insurance-specific problems. entertainment events, such as gigs; it aims to provide customers who miss events with replacement tickets to similar events rather than with cash. The trend towards InsurTechs focussing on these thorny and complex inter- nal issues for insurers looks set to continue. Amongst InsurTechs founded be- There was also a notable increase in the relative number of start-ups that tween 2013 and 2015, 33% had an internal focus; for those founded in 2016 ‘leverage data and analytics in order to generate new risk insights’. The appli- that figure has risen to 61%. cation of intelligent analytics to the vast swathes of data that insurers already have at their fingertips was always likely to prove fertile ground for start-ups - and it is proving so. The range of problems that InsurTechs are addressing has broadened over the course of the year, from a focus on the front end to truly tackling the entire insurance value chain. Peter Klingspor, Talanx

18 The reducing prevalence of start-ups looking The increasing prevalence of start-ups ‘exploring new to ‘enhance customer interactions’ approaches to underwriting risk and predicting loss’ 35% 14% 30% 12% 25% 10% 20% 8% 15% 6% 10% 4% 5% 2% 0% 0% 2016 2017 2016 2017

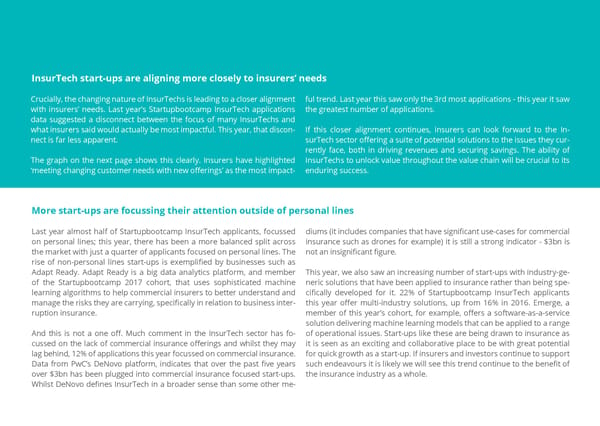

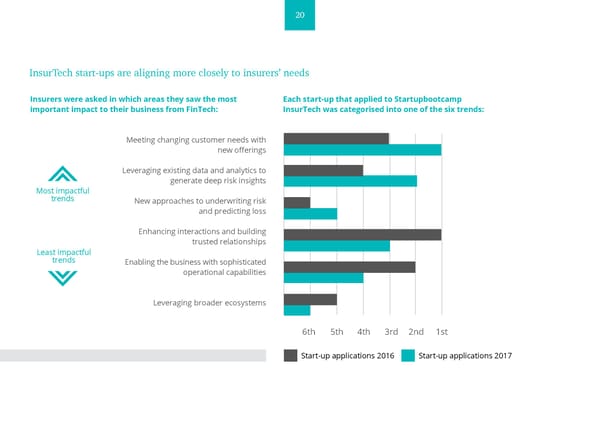

19 InsurTech start-ups are aligning more closely to insurers’ needs Crucially, the changing nature of InsurTechs is leading to a closer alignment ful trend. Last year this saw only the 3rd most applications - this year it saw with insurers’ needs. Last year’s Startupbootcamp InsurTech applications the greatest number of applications. data suggested a disconnect between the focus of many InsurTechs and what insurers said would actually be most impactful. This year, that discon- If this closer alignment continues, insurers can look forward to the In- nect is far less apparent. surTech sector offering a suite of potential solutions to the issues they cur- rently face, both in driving revenues and securing savings. The ability of The graph on the next page shows this clearly. Insurers have highlighted InsurTechs to unlock value throughout the value chain will be crucial to its ‘meeting changing customer needs with new offerings’ as the most impact- enduring success. More start-ups are focussing their attention outside of personal lines Last year almost half of Startupbootcamp InsurTech applicants, focussed diums (it includes companies that have significant use-cases for commercial on personal lines; this year, there has been a more balanced split across insurance such as drones for example) it is still a strong indicator - $3bn is the market with just a quarter of applicants focused on personal lines. The not an insignificant figure. rise of non-personal lines start-ups is exemplified by businesses such as Adapt Ready. Adapt Ready is a big data analytics platform, and member This year, we also saw an increasing number of start-ups with industry-ge- of the Startupbootcamp 2017 cohort, that uses sophisticated machine neric solutions that have been applied to insurance rather than being spe- learning algorithms to help commercial insurers to better understand and cifically developed for it. 22% of Startupbootcamp InsurTech applicants manage the risks they are carrying, specifically in relation to business inter- this year offer multi-industry solutions, up from 16% in 2016. Emerge, a ruption insurance. member of this year’s cohort, for example, offers a software-as-a-service solution delivering machine learning models that can be applied to a range And this is not a one off. Much comment in the InsurTech sector has fo- of operational issues. Start-ups like these are being drawn to insurance as cussed on the lack of commercial insurance offerings and whilst they may it is seen as an exciting and collaborative place to be with great potential lag behind, 12% of applications this year focussed on commercial insurance. for quick growth as a start-up. If insurers and investors continue to support Data from PwC’s DeNovo platform, indicates that over the past five years such endeavours it is likely we will see this trend continue to the benefit of over $3bn has been plugged into commercial insurance focused start-ups. the insurance industry as a whole. Whilst DeNovo defines InsurTech in a broader sense than some other me-

20 InsurTech start-ups are aligning more closely to insurers’ needs Insurers were asked in which areas they saw the most Each start-up that applied to Startupbootcamp important impact to their business from FinTech: InsurTech was categorised into one of the six trends: Meeting changing customer needs with new offerings Leveraging existing data and analytics to generate deep risk insights Most impactful trends New approaches to underwriting risk and predicting loss Enhancing interactions and building trusted relationships Least impactful trends Enabling the business with sophisticated operational capabilities Leveraging broader ecosystems 6th 5th 4th 3rd 2nd 1st Start-up applications 2016 Start-up applications 2017

21 Health insurance is another area where InsurTechs continue to grow (al- Another good example is InsureStreet, who, amongst other things, are though dropping slightly in relative terms from 23% of applicants in 2016 working in partnership with insurers to deliver deposit replacement insur- to 21% this year). With advances in healthcare proceeding at pace thanks ance to reduce the deposit burden on the growing number of renters in to the genomics and life sciences industries, InsurTechs see a range of op- the UK. portunities to offer clear upfront value to customers through preventative care. A good example is TrackActive, a member of this year’s cohort, which There are still some areas of insurance that are seeing less start-ups with offers insurers, healthcare providers and customers a platform designed offerings specifically for them. As Meera Last of Lloyds Banking Group to optimise rehabilitation from injury and to prevent injury and chronic points out though, “one area that still attracts a relatively small amount of disease. The data gathered from the platform is also used to drive the de- attention are pension and life offerings - there is still a heavy general insur- velopment of early intervention and prevention applications. ance focus” a point that is supported by the relatively small investment in ‘retirement savings and benefits’ start-ups tracked by DeNovo. Whilst we are seeing a greater diversity of InsurTech offerings this has not meant that there has been a decline in creativity in the personal lines Whilst reinsurance is the least invested in area, reinsurers have been very space. Indeed, there are increasingly more advanced solutions appearing active in supporting start-ups directly (for example by underwriting their that represent genuine business model innovation. Insure a Thing, from products or by direct investment), so the figures mask the number of start- the 2017 cohort, is a clear example. It offers a novel approach to bike in- ups that are relevant for reinsurers. surance by introducing a cost-plus business model based on claims settled rather than policies sold. Instead of estimating premiums upfront, it splits Regardless, more start-ups are emerging, or pivoting to insurance, all the the actual cost of claims, plus a fee, across all customers at the end of the time and as InsurTech continues to mature, this breadth will increase. month. From an initial focus on bikes, they are looking to provide insurance While the focus was initially on specific parts of insurance and its value for other products and beyond. chain, InsurTech’s impact is now being felt throughout.

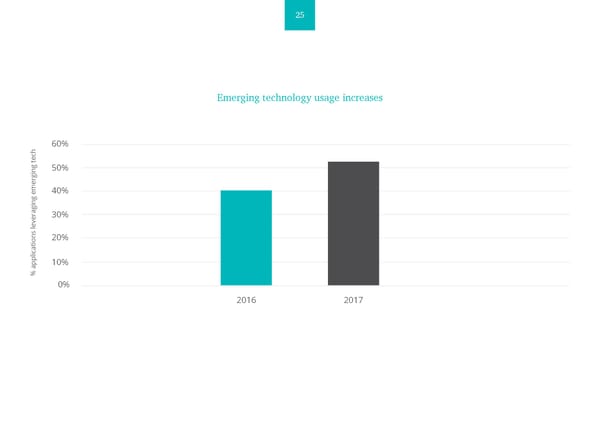

22 Emerging technologies underpin over half of our applicants’ solutions 47% 53% Established technologies Emerging technologies

23 Increasingly, emerging technologies are underpinning InsurTech solutions Over half of applicants to this year’s program employed emerging technol- Of the emerging technologies we have seen, we look at four in more detail ogies such as AI or the internet of things (IoT) compared to 40% last year, here: an increase of 13% percentage points. I. Artificial intelligence Moreover, in certain categories, emerging technologies are playing an even II. Robotics more important role. Two-thirds of applicants with businesses based on III. Internet of Things underwriting and risk management are deploying an emerging technology IV. Blockchain – such technologies clearly have the potential to drive change at the very core of the insurance operating model. This is an important trend. While InsurTechs are naturally keen to be un- I. Artificial intelligence derstood for the commercial value they could drive rather than the intri- Artificial intelligence (AI) in particular has caught the attention of the In- cacies of their primary technology, the large numbers of start-ups making surTech scene this year. Roberta Profeta of Intesa Sanpaolo is particularly compelling use cases for emerging technologies means the broader indus- excited by the potential of AI. “It’s something I’m looking forward to seeing try must get to grips with such tools. Aerobotics, an aerial data analytics applied more and more. The potential impact is enormous and multifold company and member of SBC InsurTech’s 2017 cohort, is one such exam- with a range of applications, from text mining to scouring obscure archives ple. It uses drones to capture high resolution imagery of farms and then for apparently missing bits of a policy or claim, to boosting telematics and applies machine learning to provide insight into crop health to farmers. It telesensing to proper predictive analytics, catastrophe modelling and be- now aims to deliver an agricultural insurance product that benefits both yond.” farmer and insurer, all year round.

24 And as Jehangir Byramji, Lloyds Banking Group, points out “machine learn- And this is just InsurTechs that have AI as their main proposition. The vast ing has moved beyond showcases that prove AI’s extraordinary potential; majority of InsurTech start-ups in the ecosystem use it to the point that deep learning shifted from the lab to the enterprise with open source it is essentially ubiquitous. Notably, 80% of Startupbootcamp InsurTech’s methods like TensorFlow and affordable cloud computing. We have seen 2017 cohort use AI in one form or another. For start-ups, it makes complete multiple institutions launching solutions direct to consumers, like chatbots, sense. It is often the most efficient means of completing a particular task. that benefit from Natural Language Processing and other AI methods.” And whilst it will take longer for insurers to be quite as agile, many are It is this increasing sophistication and ease of access that makes AI so ex- already using and experimenting with it and InsurTechs are well placed citing and potentially transformative. In a data-driven environment such to help them do so successfully. AIMO, for example, uses AI alongside 3D as insurance, AI offers not only the opportunity to derive insight at greater camera sensors to analyse human movement. It delivers high-precision speed and with greater accuracy but to derive new insight too. And the pos- and individualized health analytics and recommendations in real-time, of- sibilities for insurance stretch across the value chain, from the back office fering real value to health insurers and with machine learning will only be to the front. Of the Startupbootcamp InsurTech applicants this year alone getting smarter. we saw AI solutions focussing on: Moving forward, “the growing maturity of AI (machine learning) and data ››Claims and benefit management ubiquity will facilitate the insurance industry’s evolution from a ‘protection’ ››Products and pricing model to a ‘preventative’ model” suggests Mark Falconer of LV=, “such a ››Sales and distribution move doesn’t suppose that ‘insurance’ will no longer be required, however ››Underwriting and risk management it does mean we will have to re-define what ‘insurable risk’ is, and in doing ››And many single solutions with a range of applications so it will surely make more ‘risks’ insurable”. across the value chain

25 Emerging technology usage increases 60% 50% 40% 30% 20% 10% % applications leveraging emerging tech 0% 2016 2017

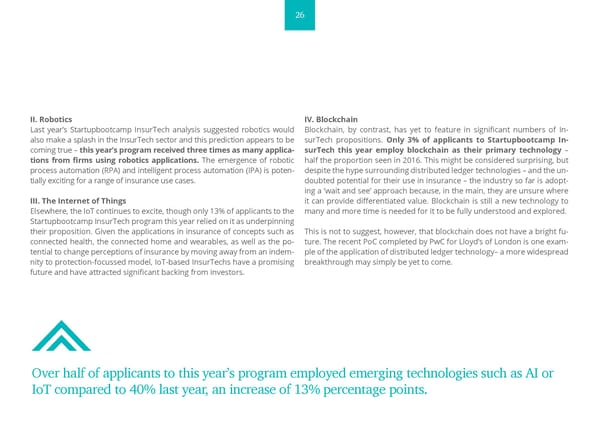

26 II. Robotics IV. Blockchain Last year’s Startupbootcamp InsurTech analysis suggested robotics would Blockchain, by contrast, has yet to feature in significant numbers of In- also make a splash in the InsurTech sector and this prediction appears to be surTech propositions. Only 3% of applicants to Startupbootcamp In- coming true – this year’s program received three times as many applica- surTech this year employ blockchain as their primary technology – tions from firms using robotics applications. The emergence of robotic half the proportion seen in 2016. This might be considered surprising, but process automation (RPA) and intelligent process automation (IPA) is poten- despite the hype surrounding distributed ledger technologies – and the un- tially exciting for a range of insurance use cases. doubted potential for their use in insurance – the industry so far is adopt- ing a ‘wait and see’ approach because, in the main, they are unsure where III. The Internet of Things it can provide differentiated value. Blockchain is still a new technology to Elsewhere, the IoT continues to excite, though only 13% of applicants to the many and more time is needed for it to be fully understood and explored. Startupbootcamp InsurTech program this year relied on it as underpinning their proposition. Given the applications in insurance of concepts such as This is not to suggest, however, that blockchain does not have a bright fu- connected health, the connected home and wearables, as well as the po- ture. The recent PoC completed by PwC for Lloyd’s of London is one exam- tential to change perceptions of insurance by moving away from an indem- ple of the application of distributed ledger technology– a more widespread nity to protection-focussed model, IoT-based InsurTechs have a promising breakthrough may simply be yet to come. future and have attracted significant backing from investors. Over half of applicants to this year’s program employed emerging technologies such as AI or IoT compared to 40% last year, an increase of 13% percentage points.

27 There are too few women in senior positions within InsurTechs Analysis of Startupbootcamp InsurTech’s application data has shown that only ensure that talent practices recognise this capability - through promotion 16% of those that applied had a female CEO, founder or co-founder. This gen- and retention policies - with a view to improving gender balance in senior der imbalance is, perhaps, not surprising when we look at the bigger picture. positions. 3 6 PwC research ‘Mending the Gender Gap’, indicates that women only held TheCityUK report into the Future of Financial and Professional Services, 19% of senior level positions, 14% of board seats and 2% of CEO roles in produced in conjunction with PwC, highlights the important role of insur- financial services firms. The recently published London Matters 2017 re- ance in society and goes on to identify talent diversity and technology as port by the London Market Group, cites the proportion of female executive two key areas critical to the future success of the UK insurance sector. The directors at just 5%.4 The picture is equally concerning in the FinTech arena move to more technology based distribution channels as a means of im- - research by Inno Tribe indicates that female executives at the top 50 Fin- proving customer engagement is considered by many insurance business- 5 es to be the key to future success. The low levels of female representation Techs make up just 4.95% of all executives. in the boardroom at InsurTech start-ups, in keeping with the current trend This pattern of declining gender balance towards senior levels within in- in the more traditional parts of the sector, is concerning. surance businesses is consistent with data from the Chartered Insurance Institute, which indicates that of those members holding Associateship or Jane Portas, Insurance Partner at PwC, commented “These findings clearly Fellowship status, only 26% and 13% respectively are women, whereas indicate that considerably more needs to be done to attract female talent among those holding Certificate status, the balance is far more even at to the insurance sector, and to improve gender balance through retention 46%. However, this imbalance also reflects the date at which the qualifica- and promotion strategies. A profession that is not representative of society tion was obtained. Considering only those who obtained the qualification will be less equipped to relate to its customers and their needs, to inno- within the last 10 years, women constitute 38% and 29% of those holding vate relevant solutions, and attract diverse talent. Creating a more diverse Associate and Fellow titles. This increase in younger women achieving qual- and inclusive profession is a business imperative, it’s simply no longer an ifications is encouraging. It will be important however for the profession to option.” 3 PwC, Mending the Gender Gap, 2013 • 4 LMG &BCG, London Matters 2017, 2017 • 5 Inno Tribe, Power Women in FinTech Index, 2015 6 TheCityUK &PwC, A Vision for a Transformed World-Leading Industry, 2017

28 The InsurTech ecosystem is still focussed on collaboration and insurers are increasingly looking outwards to innovate Last year’s report argued that collaboration will be the key to unlocking val- That said, while insurance is sometimes singled out for lacking an inno- ue. If anything, this view has strengthened over the past year with InsurTechs vative spirit, recent research found 67% of industry leaders see creativity continuing to see themselves as enablers rather than disruptors and the and innovation as very important to their organisations, ahead of other number of full stack InsurTech solutions still very low. financial services businesses.9 And examples such as that of Lloyds Banking Group show clearly how insurers are being increasingly creative in their The value that collaboration can deliver is seen in the example of NuvaLaw, interactions with start-ups, seeing them not as individual point solutions from Startupbootcamp InsurTech’s 2017 cohort, a platform that brings in- but seeing how they could combine to create even more powerful propo- surers together with a number of tools, processes and services to reduce sitions. the time and cost involved in settling claims. NuvaLaw is designing a new process to handle inter-insurer motor damage and personal injury claims; For example, Derek Smith, Head of Insurance Innovation at Lloyds Banking its online dispute resolution service, which employs AI and platform tech- Group notes that “partnering with Startupbootcamp InsurTech has helped nologies, has the potential to deliver a 40% reduction in costs and capital us gain access to new technology, business models and emerging custom- outlays, and resolves claims at four times the speed of court-based set- er needs. Teams from across our division are now running multiple PoCs tlements. If insurers work together through solutions such as NuvaLaw’s with companies from the cohorts and events run by the team. there is huge value to be created. As an example, the General Insurance and Innovation teams are partnering Insurers increasingly recognise the opportunity that InsurTech presents with three of Startupbootcamp’s companies to build and live test future them and are looking outwards to innovate. In 2016, just 28% of insurers home insurance propositions that address customers’ needs of tomorrow 7 surveyed had begun exploring partnerships with InsurTechs. By 2017, 45% by proactively reducing physical and cyber risks in the home.” said they were directly engaging. Other insurers have work to do, however, with a further 42% of the firms surveyed conceding they are not even mon- Still, despite such examples, insurers must be prepared to put their money 8 where their mouths are: PwC’s 2017 FinTech survey found that while finan- itoring the InsurTech space. cial services companies plan to spend an average of 15% of annual turnover on their technology programs, the figure for insurers is only 7%. 7 PwC, FinTech Survey, 2016 • 8 PwC, FinTech Survey, 2017 • 9 PwC, CEO Survey, 2017

29 How do insurers 58% 45% 30% currently engage monitor InsurTech in order engage in partnerships with buy the services of InsurTech with InsurTechs? to respond competitively InsurTech companies companies to improve their operations and services 21% 14% 11% 8% establish start-up programs set up venture funds to fund acquire InurTech do not deal with to incubate InsurTech InsurTech companies companies InsurTech companies Source: PwC, Insurance’s new normal Driving innovation with InsurTech, (2017)

30 3. Enabling collaboration KEY TAKEAWAYS FROM THIS CHAPTER: Successful collaboration between in- surers and InsurTech requires both sides to overcome process and cul- ture challenges. Finding a way through data security anxieties will help collaborations un- lock value. Focus on expectations and execution to give collaborations the best possi- ble chance of success.

31 While insurers and InsurTechs alike agree that collaboration between start-ups and more established businesses is the key to driving value, both groups also agree that working together isn’t always easy. Their difficulties typically fall into two categories: PROCESS. Many collaborations are prevented simply by the practical questions of how to ensure buy-in from all the key stakeholders. For example, insurers worry about the legal arrangements, particularly around data sharing, and struggle with procurement processes not designed for engaging with small start-ups. Still some insurers are now making good progress in solving these problems. CULTURE. If start-ups are speedboats – quick and agile but unstable in choppy waters – and established insurers are oil tankers – powerful and strong but slow to change directions – bringing the two together inevitably brings challenges. Both sides have to be prepared to overcome their frustrations with one anoth- er, finding compromises to move past these perceived weaknesses. And both do recognise these issues. A survey conducted by Startupbootcamp found 72% of start-ups worried about how to collaborate with larger businesses, with 59% complaining they had made more than 10 calls before tracking down the right person to discuss a joint initiative; Half (48%) said 10 agreeing a deal had taken more than six months. PwC research, meanwhile, suggests only 17% of insurers believe they are good at co-creations with 11 start-ups, against 28% of financial services firms generally. The survey found IT security was the concern most likely to represent a stumbling block. 10 Startupbootcamp, Collaborate to Innovate, 2017 • 11 PwC, FinTech Survey, 2017

32 The data dilemma Data underpins the activities of insurance companies, and many InsurTech ventures are predicated on their ability to exploit data. However, information sharing is uncomfortable for insurers, particularly where projects may be short-lived PoCs. They fear breaches that could lead to legal or regulatory sanc- tion, as well as significant reputation damage. In PwC research, 63% of insurers highlighted data security, privacy and protection as one of their biggest barriers to innovation, higher than the 54% recorded across the financial services industry as a whole. InsurTechs are simply unlikely to have the data security accreditations insurers require as a 12 minimum standard when working with partners. Moreover, regulatory concerns are likely to increase, when the European Union’s General Data Protection Regulation (GDPR) comes into force in May 2018, imposing greater responsibilities on all organisations that hold personal data – as well as much larger fines for failures. Still, changes such as the GDPR can also be seen as an opportunity to engage more positively with consumers. PORT, for example, is a start-up that aims to make it easier for businesses to comply with the GDPR using tools that enable practical compliance; in the longer term, it hopes to facilitate an infor- mation-sharing process where consumers can see how they are benefitting from allowing access to their data while also maintaining control. Such examples provide an important lesson: if more businesses can find a way to overcome their data challenges, the value on offer is huge. 12 PwC, FinTech Survey, 2017

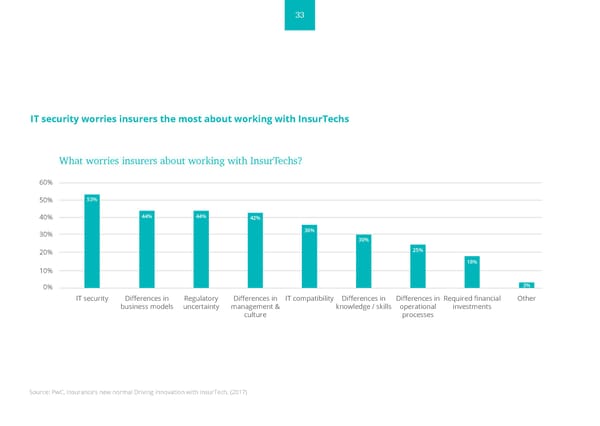

33 IT security worries insurers the most about working with InsurTechs What worries insurers about working with InsurTechs? 60% 50% 53% 40% 44% 44% 42% 30% 36% 30% 20% 25% 18% 10% 0% 3% IT security Differences in Regulatory Differences in IT compatibility Differences in Differences in Required financial Other business models uncertainty management & knowledge / skills operational investments culture processes Source: PwC, Insurance’s new normal Driving innovation with InsurTech, (2017)

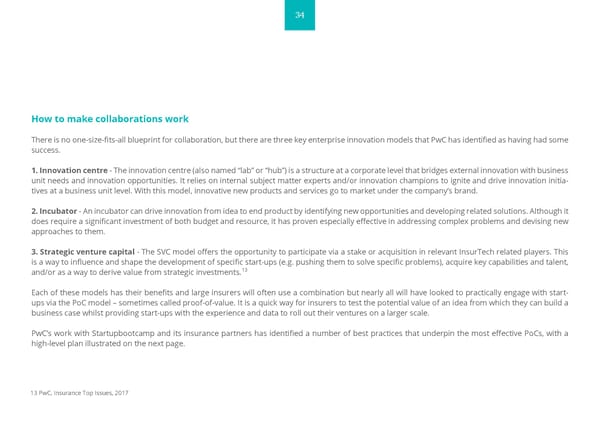

34 How to make collaborations work There is no one-size-fits-all blueprint for collaboration, but there are three key enterprise innovation models that PwC has identified as having had some success. 1. Innovation centre - The innovation centre (also named “lab” or “hub”) is a structure at a corporate level that bridges external innovation with business unit needs and innovation opportunities. It relies on internal subject matter experts and/or innovation champions to ignite and drive innovation initia- tives at a business unit level. With this model, innovative new products and services go to market under the company’s brand. 2. Incubator - An incubator can drive innovation from idea to end product by identifying new opportunities and developing related solutions. Although it does require a significant investment of both budget and resource, it has proven especially effective in addressing complex problems and devising new approaches to them. 3. Strategic venture capital - The SVC model offers the opportunity to participate via a stake or acquisition in relevant InsurTech related players. This is a way to influence and shape the development of specific start-ups (e.g. pushing them to solve specific problems), acquire key capabilities and talent, 13 and/or as a way to derive value from strategic investments. Each of these models has their benefits and large insurers will often use a combination but nearly all will have looked to practically engage with start- ups via the PoC model – sometimes called proof-of-value. It is a quick way for insurers to test the potential value of an idea from which they can build a business case whilst providing start-ups with the experience and data to roll out their ventures on a larger scale. PwC’s work with Startupbootcamp and its insurance partners has identified a number of best practices that underpin the most effective PoCs, with a high-level plan illustrated on the next page. 13 PwC, Insurance Top Issues, 2017

35 A framework for proof-of-concept work Identify & assess Onboard Define & prepare Execute Evaluate Go / no-go Scouting for and Overcome all necessary Working with the start-up Run the Analyse the results Decision as to how assessing potential administrative hurdles and in line with corpo- PoC within and assess against to move forward capability appropriate in order to onboard rate objectives, define the defined the pre-agreed based upon the start-ups that will solve the start-up and make the PoC. Crucially, define timeframe and success criteria. results of the PoC. a business problem / the PoC a success. This what success looks like. limits. Monitor Socialise results meet a business need. should be a clearly Ensure that everything is the results. Dis- with the key stake- Should be aligned to defined and simplified in place (environments, pose of data. holders. corporate objectives. process when com- etc.) so the PoC can run pared to BAU. smoothly.

36 In practice, our recommendations fall into two categories: i. Expectations ii. Execution ››Set a clear and limited scope for the proof-of-concept, with all stake- ››Follow a clear method. Having agreed a process for working, make sure holders agreed on the problem that is to be solved. Focus on a specific all stakeholders understand the plan and the broader governance struc- question and the technical response required. tures, and that they stick to them. ››Align expectations. Insurers and InsurTechs must collaborate to agree ››Pick the right team. Use as small a team as possible to avoid complexity, the scope of the PoC, agreeing roles and responsibilities, as well as ways but ensure all key stakeholder groups have representation. Ideally, insur- of working. ers will put someone on each PoC on a full-time basis, but beyond the project look for champions across the business to enhance its reach. Start- ››Set clear deadlines. These timescales must be adhered to strictly. ups must be careful to balance the demands of the PoC with business as usual but ensure they give enough to build the relationship and deliver ››Identify clear deliverables. Set out what the PoC will deliver, both in successfully. terms of final outcomes and project documentation. ››Set up an independent environment. It is best practice to set up an in- ››Define success. Agree targets for the PoC, as well as the metrics on which dependent environment for the PoC to operate within. Sharing environ- progress will be measured. ments can become messy and jeopardise the PoC. ››Identify next steps. Agree at the outset what will happen following a suc- cessful PoC, with clear actions for all stakeholders. If start-ups are speedboats – quick and agile but unstable in choppy waters – and established insurers are oil tankers – powerful and strong but slow to change directions – bringing the two together inevitably brings challenges.

37 4. What next for InsurTech? We see a bright future for InsurTechs and insurers alike, with successful collaboration offering the potential to unlock significant value throughout the industry. There is a caveat, however: the window of opportunity will not remain open indefinitely.

38 1. The short-term outlook for InsurTech InsurTech will come of age and begin driving significant value ››With partnerships, pilots and PoC initiatives now underway, InsurTechs are moving closer to full roll-out of their technologies. These can deliver significant value for insurers while driving an improved customer experience Investment and interest in InsurTech will continue to increase ››We will see a number of InsurTechs starting to scale at speed and raise significant levels of new funding ››Success for the InsurTech pioneers will inspire other entrepreneurs and encourage investors and insurers to support more start-ups ››However, disappointments could be a brake on progress, with insurers becoming more reluctant to commit resources to collaborations if they are not prepared to fail fast Emerging technologies will become increasingly widely exploited ››Technologies such as artificial intelligence and machine learning will become ubiquitous, finding use cases across the value chain ››More nascent technologies, including Blockchain, will also begin delivering value in insurance InsurTechs will lead innovation as insurers respond to the changing landscape ››InsurTechs hold the key to enabling insurers to respond to the unprecedented pace of change in their operating environment ››The connected home and the sharing economy will provide further challenges and opportunities with which InsurTechs can help insurers ››Despite this, established insurers will start to have a greater influence on the direction of travel as they guide InsurTechs using their deep knowledge

39 2. The long-term outlook for InsurTech If insurers aren’t careful, collaboration will become disruption ››Insurers that fail to exploit collaboration opportunities will lose ground to rivals and new entrants able to drive value through innovation driven by InsurTech partnerships ››New entrants from beyond insurance could enter the industry with InsurTech partners. We are already seeing reinsurers bypass primary insurers with InsurTech partners, but perhaps a greater threat will come from technology companies as well as the utility and telecoms sectors, as these businesses find ways to expand their current suites of products and enter new markets ››InsurTechs may also choose to go it alone, working with other start-ups or individually as they attract further venture capital funding. Recent Start upbootcamp research found 40% of InsurTechs saw themselves as disruptors rather than enablers and the potential for more full stack InsurTechs 14 to emerge is there Greater cross-industry collaboration will drive customer centricity and financial wellness ››Working with other sectors of the financial services industry, InsurTechs will be part of the move towards more holistic financial services, with consumers accessing a full overview of their finances through a single portal; this trend has significant potential benefits for financial wellness ››Industry boundaries will continue to blur as insurers (and others) use technology to deliver preventative solutions as well as insurance. A good example where this is already happening is CBien, the start-up in residence for this year’s cohort. It is a digital asset management platform that helps people secure, value and manage their possessions, with an option to insure them as part of their more comprehensive solution ››We will move from a crowded marketplace to a world where a handful of key players drive the wellness agenda and ensure consumers have total control of their finances 14 Startupbootcamp InsurTech, Startup Survey, 2017

40 Conclusion Is the InsurTech sector living up to its potential to be ‘transformational for the wider insurance industry’ as we predicted in last year’s report? We think it is and it has gathered real momentum this year. With increasingly sophisticated start-ups offering solutions across the insurance value chain the potential benefits that could be created for insurers, investors and customers alike is huge. Critically, there is now a thriving ecosystem, built on collaboration, working hard to create that value. Barring a few well known exceptions, the majority of the most exciting start-ups are still in their early stages or piloting their propositions. As they move for- ward in the months ahead InsurTech will reach an exciting and critical phase. Everything seems to be in place for the transformational nature of InsurTech to be realised. It will be down to those involved to deliver it. Succeed and the floodgates could open, fail and InsurTech, and the future of insurance, could suffer a major setback. It is a remarkable position for such a young sector to be in but it is reflective of the pace of change that is the new normal in the world today. A pace of change that is the reason the insurance industry must be agile and jump at the opportunity that InsurTech presents to deliver for the good of all - new entrants, incumbents and customers.

41 A closing note from Sabine VanderLinden Over 36 months on and it looks like InsurTech will remain a force for good. As we continue to work, support and interact with a multitude of early The market is evolving at a fast pace and it is now empowering teams to adopters, insurance brands and investors, we will pursue our vision of en- address the digital transformation agenda in unconventional and innova- abling true collaboration between innovative gems and the insurance sec- tive ways. Many insurers have now dedicated significant resources and are tor we all care so much for. building departments of experts who are able to screen and interact with start-ups, from early stage to mature ones. Furthermore, they are doing I can confirm that there are 1000s of highly effective and interesting start- this in an increasingly smart manner as they identify ventures that show ups that are incredibly relevant for a changing insurance landscape. This the best fit and alignment with their strategic direction and imperatives. year we have seen an increasing number of InsurTechs coming out of stealth mode, aiming to tackle more complex often internally focussed While we will continue to hear and read about disruptive InsurTech brands, problems, and a multitude of technologies is at the core of this enablement. for most it will be their ability to partner with insurance providers that will determine their success. Collaboration is still very much the glue that holds It is an incredibly exciting time for everyone involved in InsurTech and I can- the ecosystem together and the oil that will keep it running smoothly. not wait to see where we stand in one year’s time. One thing is for certain - it won’t be where we are now! As digital first personal lines platforms become more pervasive, the more complex needs of commercial lines providers will become a key focus area for start-ups looking at technology as a means to improving internal pro- cesses across the insurance value chain. It is likely that we will see InsurTechs moving their focus towards delivering fuller stack platforms. As this happens the mid and back office will gradu- ally become more prevalent as will robotics-led servicing, advanced pricing techniques, precision risk scoring, and digital claims platforms focussed on addressing specific weaknesses across ecosystems of interactions.

42 PwC Startupbootcamp InsurTech PwC works with insurance companies to implement Startupbootcamp InsurTech is the leading accelerator InsurTech innovation, from strategy through execution, focussed on financial innovation. We provide funding, and helps InsurTech start-ups accelerate and scale their mentorship, office space in the heart of London and businesses to reach their full potential. access to a global network of investors and VCs, for up to 10 selected InsurTech start-ups from across the globe. Jonathan Howe Sabine VanderLinden Global InsurTech Leader Global Managing Director PwC Startupbootcamp InsurTech jonathan.p.howe@pwc.com sabine@startupbootcamp.org Graham Jackson Megan Hayes UK Insurance Technology Leader Program Director PwC Startupbootcamp InsurTech graham.jackson@pwc.com megan@startupbootcamp.org Chris Smith Filippo Sanesi InsurTech Consultant (report author) Head of Research & Partner Management PwC Startupbootcamp InsurTech christopher.x.smith@pwc.com filippo@startupbootcamp.org

43 For further information please contact: Katherine Dvorkin PR Director, Startupbootcamp InsurTech +44 7766 105227 katherine.dvorkin@startupbootcamp.org visit www.startupbootcamp.org/accelerator/insurtech-london For more information about InsurTech at PwC please contact: Jessica Houston Marketing Executive Financial Services, PwC UK +44 2072131269 jessica.houston@pwc.com visit www.pwc.co.uk/insurance In this document “PwC” refers to the UK member firm, and may sometimes refer to the PwC network. Each member firm is a separate legal entity. Please see www.pwc.com/structure for further details. © 2017 Startupbootcamp InsurTech. All rights reserved.

44 Extra credit and thank you Mattias Bergstrom Kristin Bell Alessandro Allotta Insurance Strategist Head of Marketing Lead Scout & Investor Relations PwC Startupbootcamp InsurTech Startupbootcamp InsurTech mattias@pwc.com kristin@startupbootcamp.org alessandro.allotta@startupbootcamp.org Steven Gough Katerina Stergianopoulou Mariusz Spychala UK Insurance Customer & Tech Leader Head of Design (report designer) Data Analyst Intern PwC Startupbootcamp InsurTech Startupbootcamp InsurTech steven.j.gough@pwc.com katerina@startupbootcamp.org mariusz@startupbootcamp.org

45