Breaking Boundaries | PwC & Startupbootcamp

How InsurTech is moving beyond insurance

Breaking Boundaries How InsurTech is moving beyond insurance

2 Executive Reaching new parts Securing value 05 summary 07 of the value chain 10 from data Enabling new propositions Customer experience InsurTechs continue 13 beyond insurance 19 outside insurance sets 21 to enhance insurers’ the standard operations Innovation, talent What’s next for Closing remarks 22 and diversity 29 InsurTech 31 from Sabine

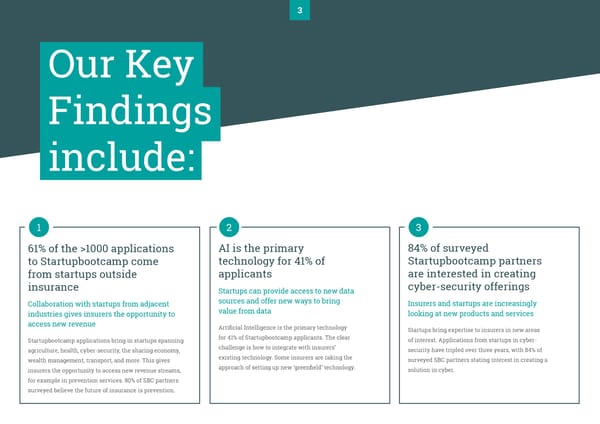

3 Our Key Findings include: 1 2 3 61% of the >1000 applications AI is the primary 84% of surveyed to Startupbootcamp come technology for 41% of Startupbootcamp partners from startups outside applicants are interested in creating insurance Startups can provide access to new data cyber-security offerings Collaboration with startups from adjacent sources and offer new ways to bring Insurers and startups are increasingly industries gives insurers the opportunity to value from data looking at new products and services access new revenue Artificial Intelligence is the primary technology Startups bring expertise to insurers in new areas Startupbootcamp applications bring in startups spanning for 41% of Startupbootcamp applicants. The clear of interest. Applications from startups in cyber- agriculture, health, cyber-security, the sharing economy, challenge is how to integrate with insurers’ security have tripled over three years, with 84% of wealth management, transport, and more. This gives existing technology. Some insurers are taking the surveyed SBC partners stating interest in creating a insurers the opportunity to access new revenue streams, approach of setting up new ‘greenfield’ technology. solution in cyber. for example in prevention services. 80% of SBC partners surveyed believe the future of insurance is prevention.

4 4 5 6 5% of applicants are focused 20% of applicants support InsurTech has pushed on customer interactions operational improvements insurers’ innovation Applications from startups focused on Operational improvement continues to agenda front-end interactions have dramatically be a key area Innovation moves from Proof of Concepts fallen towards scale The pressure within insurance to keep costs low In 2016, 36% of applicants were solely about improving fuels the large proportion of startups with a focus InsurTech has brought an influx of technology customer interactions and relationships. In 2018, this on improving the operational efficiency of startups. talent into the industry. This new talent has has fallen to just 5%. This is not to say that insurers Insurers are becoming more open to work with brought a change in culture, whilst innovation in are have stopped caring about the customer. Insurers startups supporting efficiency insurance is moving from watch and learn, towards are looking for meaningful ways to improve the executing proof of concepts and scaling them in experience of their customers, often through omni- the business. channel approaches. 7 8 23% of startup Disruption will come from applications had female scale-ups working with founders/co-founders reinsurers Gender diversity has improved but has Tech giants are not the only competition a long way to go As well as competition from tech giants, mature startups Startups with female founders/co-founders has with specialisms in different parts of the value chain risen from 16% in 2017 to 23% in 2018. However, have the potential to come together to launch their own application data shows that men are five times greenfield venture. In this scenario, we expect these more likely to hold a Chief Technology Officer scale-ups to work directly with first mover reinsurers to position, whilst women are twice as likely to be provide capacity. This could cut insurers and slow moving Chief Marketing Officers. reinsurers out of the mix.’

5 Executive Summary: InsurTech is “Insur”Tech no more Over three years of Startupbootcamp InsurTech, the narrative surrounding InsurTech has shifted. In year one, the debate focused on how startups would 61% of Applicants disrupt the incumbent insurance sector. In year two, the emphasis moved to in 2018 were those collaboration, as startups and insurers pondered how to combine the former’s “beyond insurance” 61% technology with the latter’s customer knowledge, understanding of risk, and capital strength. These collaborations looked beyond front-end focused applications in order to solve problems throughout the value chain. Now, in year three of Startupbootcamp (SBC), this evolution is continuing. Startupbootcamp InsurTech is strongly InsurTech is increasingly about supporting insurers to innovate beyond the influenced by the innovation direction of its existing value chain into new industries and to offer new value to clients. In insurance partners. PwC has been a partner of Startupbootcamp InsurTech which case, the question becomes, is InsurTech really “Insur”Tech anymore? throughout the three programs. Over time, the opportunity has broadened – It is possible to categorize the Startupbootcamp applicants into those startups insurers are now focused on the promise of innovation from beyond the confines that sit within insurance and those that are beyond the sector. The latter group of their own sector. includes: In other words, the term InsurTech itself now increasingly falls short of • startups focused on an entirely different industry and with value to that describing what these startups offer. Rather, the emerging picture is now of industry regardless of applications in insurance - examples include firms an ecosystem that brings together adjacent industries to provide an improved offering preventive services to property managers; service of greater value to insurers and their customers. Adjacent industries • startups that provide services which are industry-agnostic, but which of particular relevance include agriculture, health, cyber-security, the sharing now hope to serve the insurance sector – examples include firms offering economy, wealth management and transport, though there are many other customer service enhancement. examples too. PwC has been a partner of Startupbootcamp InsurTech since throughout the three programmes. Not only has Startupbootcamp seen an overall increase in applications each Jim Bichard, UK insurance leader at PwC, comments on the changing nature year, over 1000 in 2018, but more and more applications are coming from startups of the ecosystem: “Three years ago the hype was about startups disrupting primarily focused on adjacent industries - they see that insurance is ripe for traditional insurers. Now the talk - and increasingly the reality - is about startups innovation. This report looks into the 226 startups that were taken through to and insurers working together to create meaningful partnerships. All parties the final stages of selection*. This year, 61% of Startupbootcamp applicants were are working together and learning from other sectors to solve problems within from beyond insurance – and the trend on the program itself is clear. While insurance and react to the changing outside world. This approach to innovation 75% of the 2016 Startupbootcamp cohort were clearly within insurance, 80% of is creeping up the agenda for our insurance clients.” this year’s selection operate beyond the sector; they could standalone without insurers but now hope to sell to the industry or collaborate with its incumbents. *going forwards in this report, ‘applicants’ will refer to the 226 startups who were taken through to the final stages of Startupbootcamp InsurTech’s application process

6 Startupbootcamp Cohort: The startups broaden beyond insurance 80% 70% Beyond insurance: 60% Startups focused on an entirely different industry and with value to that industry regardless of 50% applications in insurance; or startups that provide services which are industry-agnostic but 40% are now moving into insurance. 30% Within insurance: Startups with offerings specific 20% only to insurance. 10% 2016 2017 2018 Within Beyond Note: This graph shows refers to Startupbootcamp InsurTech London Cohort, the nine to 11 startups selected from the hundreds of applications each year.

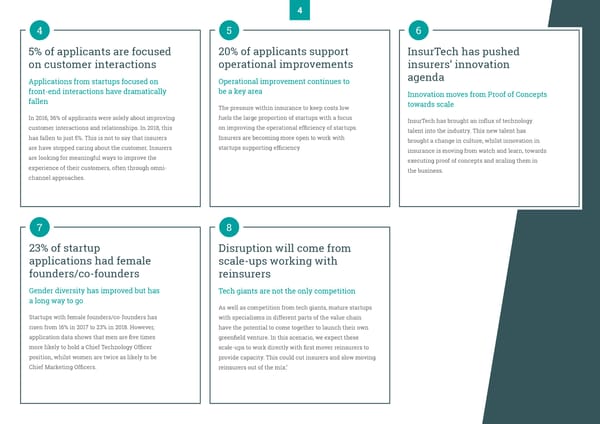

7 The InsurTech ecosystem - startup applications Enterprise Security 11% with a focus on adjacent industries. Figur 1. Reaching new parts of the value chain e 2: Th Startups from beyond insurance give insurers the e Insur opportunity to access different parts of the value FinTech 3% T chain and to move into prevention. Indeed in our Travel & Transport 8% ech survey, 80% of incumbent partners of SBC agree ecosyste that prevention is part of the future for insurers. For their part, insurers acknowledge that to expand Mobile 4% m- star their existing value chain, they should be offering additional value to clients. As data becomes more tup app real-time and extensive, each risk pool effectively Health Tech 25% shrinks to one, and the value comes in preventing lications now predictable risks from occurring. At Zurich, one insurer that has been involved with Fashion Tech 2% with Sharing Economy 16% Startupbootcamp over the past two years, Antony a Elliott, Group Head of Business Transformation focus at Zurich Insurance, says collaborations with on startups are now evolving. “Our initial involvement oth HR Tech 2% er with the InsurTech landscape helped us become a in more customer-centric organization. Now we are Legal Tech 2% dustries. becoming increasingly outwards looking, through additional services and looking more broadly beyond insurance.” Wealth Management 11% Fitness & Wellness 3% “InsurTech is changing the way in which propositions can work, thinking about the customer holistically. For example, we are interested in £ the ecosystem around the home and commercial AgriTech 9% properties, looking to further our understanding of E-commerce 3% what our customers want, and then who to partner with to meet those needs.” PropTech 2%

8 Innovation beyond insurance: insurance collaboration use cases Industry: AgriTech Industry: PropTech Insurance use case: Insurance use case: The use of drone and satellite At its most basic, PropTech gives technology in agriculture is users remote control of property increasing: satellite data is helping Startupbootcamp 2018 features such as lights, heating Startupbootcamp 2018 to predict environmental factors startup: and blinds, but sophistication is startup: to support farming activities growing. For example, the increased and improve yield, and to help CyStellar operates a platform use of the Internet of Things (IoT) Exploiting IoT devices, analytics farmers tackle localized issues. For that integrates, manages and in property is helping commercial technology and an insights insurers, this data offers a means to secures data from ground property managers and home platform, Flowenum helps reduce crop claims with precision sensors, aerial surveillance owners to predict and prevent commercial property managers to agriculture – and to extend cover to and satellite imagery. The data events such as fire from faulty minimize problems such as damp the uninsured, particularly in rural powers applications such as equipment, water leaks or theft. and mould – and to plan their areas in Africa. precision agriculture, predictive maintenance programs more maintenance, or logistics for efficiently. fully interactive, predictive decision making. Their near real-time data allows them to support insurers in the case of catastrophe incidents, where it is often costly and difficult to collect information.

9 Industry: HealthTech Industry: Enterprise Security Insurance use case: Insurance use case: HealthTech tools harnessing the PwC’s research suggests just 53% IoT and wearable devices give of companies have an overall individuals access to a wealth of information security strategy. More Startupbootcamp 2018 information about their wellbeing – Startupbootcamp 2018 startups are entering this space to and provide opportunities such as startup: help firms understand and mitigate startup: the means to encourage change or vHealth Lab uses artificial risk. Cyber insurance has the Zeguro helps small and medium- manage medication. For insurers, intelligence technologies to help potential to be the fastest-growing sized enterprises manage the opportunities include the possibility cardiac patients monitor their sector of the industry. Insurers are threat with a virtual cyber-security of new value-added services, better heart at home and make smart moving beyond offering cover to officer. Able to continually identify prevention and increased risk data. therapy decisions accordingly. partner with cyber-security experts and mitigate risk, it can offer offering risk management and companies the right insurance prevention platforms. against cyber threats.

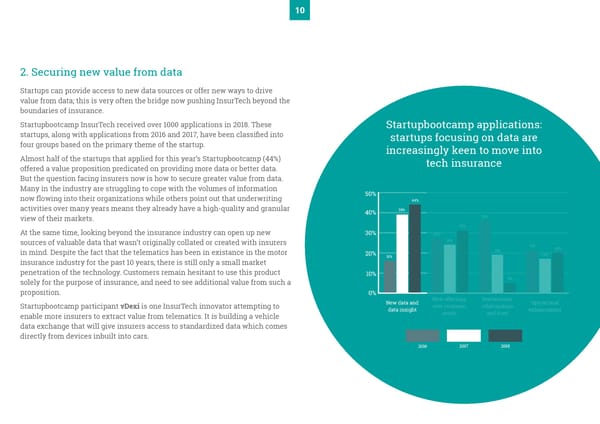

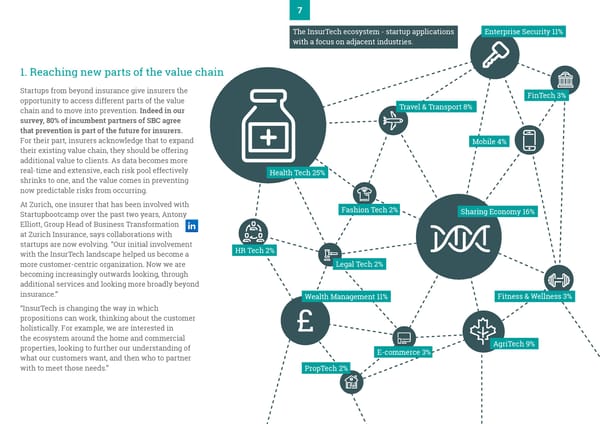

10 2. Securing new value from data Startups can provide access to new data sources or offer new ways to drive value from data; this is very often the bridge now pushing InsurTech beyond the boundaries of insurance. Startupbootcamp InsurTech received over 1000 applications in 2018. These Startupbootcamp applications: startups, along with applications from 2016 and 2017, have been classified into startups focusing on data are four groups based on the primary theme of the startup. increasingly keen to move into Almost half of the startups that applied for this year’s Startupbootcamp (44%) tech insurance offered a value proposition predicated on providing more data or better data. But the question facing insurers now is how to secure greater value from data. Many in the industry are struggling to cope with the volumes of information 50% now flowing into their organizations while others point out that underwriting 44% activities over many years means they already have a high-quality and granular 40% 39% view of their markets. 36% 31% At the same time, looking beyond the insurance industry can open up new 30% 27% sources of valuable data that wasn’t originally collated or created with insurers 24% 21% 20% in mind. Despite the fact that the telematics has been in existance in the motor 20% 19% 16% 17% insurance industry for the past 10 years, there is still only a small market penetration of the technology. Customers remain hesitant to use this product 10% solely for the purpose of insurance, and need to see additional value from such a 5% proposition. 0% New data and New offerings, Interactions, Operational Startupbootcamp participant vDexi is one InsurTech innovator attempting to data insight new customer relationships enhancement enable more insurers to extract value from telematics. It is building a vehicle needs and trust data exchange that will give insurers access to standardized data which comes directly from devices inbuilt into cars. 2016 2017 2018

11 “Without access to connected vehicle data, insurance companies will struggle Data interpretation to provide competitive and profitable vehicle insurance moving forward,” the Other startups offer use cases and applications that convert the implicit value company argues. “Through vDexi, insurance companies can access standardized in data into realizable insight – for example, through real-time risk assessment vehicle data from all vehicle owners.” analytics. Another startup providing insurers access to existing data collected for purposes ZASTI is a startup that has built an artificial intelligence-powered data platform other than insurance is Startupbootcamp 2018 program participant CyStellar, that is able to help many different industries anticipate emerging risks, with whose IoT devices, and satellite data supports farmers to improve their crop successful use cases in aviation, healthcare and compliance. In aviation, precision. This data, is also extremely useful to insurers when it comes to ZASTI is able to combine new data sources from IoT devices, with existing data accessing data in areas they currently don’t have any. For example, it enables and historic data sets to predict flight delays; engine failures and can plan to the industry to provide support in areas such as incidents of catastrophe, where minimize these risks. solutions are currently in short supply. This data analysis is bringing deep insight to companies in aviation, but can also be applied to an insurance context. Partnering with startups that Partnering with startups that have the skills to exploit the exponentially increasing volumes of data in this way will be crucial for insurers. Currently, have the skills to exploit the incumbent insurers – hampered by legacy IT infrastructure and competing in a exponentially increasing volumes fierce market for data scientists – are struggling to drive actionable insight from data, particularly in real-time, with unstructured data posing an especially tough of data in this way will be crucial challenge. Harnessing the skills of startups, which are already being applied for insurers. successfully in industries beyond insurance, will therefore be crucial. Gregor Wiest, Head of Innovation at Ergo Group, highlights the AI priority at Ergo. “Amongst evaluating new propositions of digital health and mobility, we are heavily focused on exploring how AI can enable areas such as underwriting and claims. Our business has the willingness and openness to change and collaborate with startups, but like many insurers we have some constraints from legacy systems. Still, in the future we will put more emphasis on collaborating with startups, and expect the importance of this to increase.”

12 The technology focus of applicants 45% The chart shows the primary technology of startups that applied 40% for Startupbootcamp InsurTech over the course of three years. The most 35% significant increase over the period is in the number of startups using advanced analytics and big data. 35% This is one consequence of the number of startups using artificial intelligence as a 30% core technology in their business. 25% 2016 20% 15% 2017 10% 2018 5% Internet of Advanced Autonomous Things and Analytics & Big Robotics Vehciles Blockchain Cyber Sensors Data

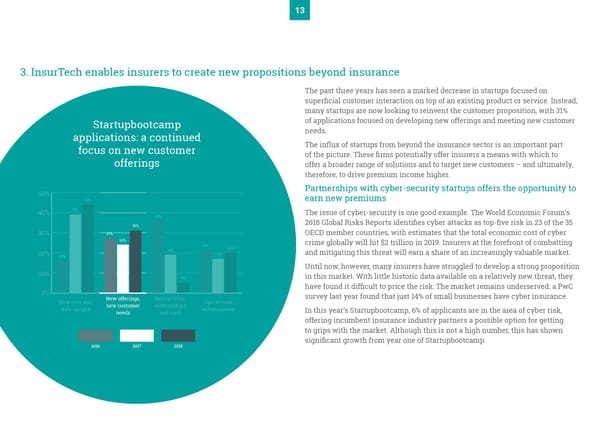

13 3. InsurTech enables insurers to create new propositions beyond insurance The past three years has seen a marked decrease in startups focused on superficial customer interaction on top of an existing product or service. Instead, many startups are now looking to reinvent the customer proposition, with 31% Startupbootcamp of applications focused on developing new offerings and meeting new customer applications: a continued needs. focus on new customer The influx of startups from beyond the insurance sector is an important part offerings of the picture. These firms potentially offer insurers a means with which to offer a broader range of solutions and to target new customers – and ultimately, therefore, to drive premium income higher. 50% Partnerships with cyber-security startups offers the opportunity to 44% earn new premiums 40% 39% The issue of cyber-security is one good example. The World Economic Forum’s 36% 31% 2018 Global Risks Reports identifies cyber attacks as top-five risk in 23 of the 35 30% 27% OECD member countries, with estimates that the total economic cost of cyber 24% crime globally will hit $2 trillion in 2019. Insurers at the forefront of combatting 21% 20% 20% 19% and mitigating this threat will earn a share of an increasingly valuable market. 16% 17% Until now, however, many insurers have struggled to develop a strong proposition 10% 5% in this market. With little historic data available on a relatively new threat, they have found it difficult to price the risk. The market remains underserved: a PwC 0% survey last year found that just 14% of small businesses have cyber insurance. New data and New offerings, Interactions, Operational data insight new customer relationships enhancement In this year’s Startupbootcamp, 6% of applicants are in the area of cyber risk, needs and trust offering incumbent insurance industry partners a possible option for getting to grips with the market. Although this is not a high number, this has shown significant growth from year one of Startupbootcamp. 2016 2017 2018

14 The number of startup applicants focusing on cyber has tripled from 2016 to 2018 x3

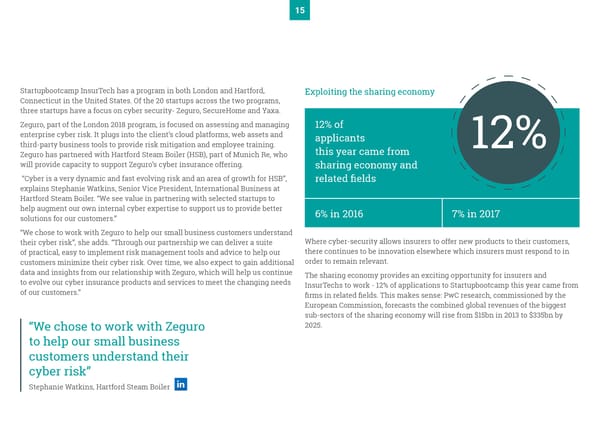

15 Startupbootcamp InsurTech has a program in both London and Hartford, Exploiting the sharing economy Connecticut in the United States. Of the 20 startups across the two programs, three startups have a focus on cyber security- Zeguro, SecureHome and Yaxa. Zeguro, part of the London 2018 program, is focused on assessing and managing 12% of enterprise cyber risk. It plugs into the client’s cloud platforms, web assets and applicants third-party business tools to provide risk mitigation and employee training. this year came from 12% Zeguro has partnered with Hartford Steam Boiler (HSB), part of Munich Re, who will provide capacity to support Zeguro’s cyber insurance offering. sharing economy and “Cyber is a very dynamic and fast evolving risk and an area of growth for HSB”, related fields explains Stephanie Watkins, Senior Vice President, International Business at Hartford Steam Boiler. “We see value in partnering with selected startups to help augment our own internal cyber expertise to support us to provide better 6% in 2016 7% in 2017 solutions for our customers.” “We chose to work with Zeguro to help our small business customers understand their cyber risk”, she adds. “Through our partnership we can deliver a suite Where cyber-security allows insurers to offer new products to their customers, of practical, easy to implement risk management tools and advice to help our there continues to be innovation elsewhere which insurers must respond to in customers minimize their cyber risk. Over time, we also expect to gain additional order to remain relevant. data and insights from our relationship with Zeguro, which will help us continue The sharing economy provides an exciting opportunity for insurers and to evolve our cyber insurance products and services to meet the changing needs InsurTechs to work - 12% of applications to Startupbootcamp this year came from of our customers.” firms in related fields. This makes sense: PwC research, commissioned by the European Commission, forecasts the combined global revenues of the biggest sub-sectors of the sharing economy will rise from $15bn in 2013 to $335bn by “We chose to work with Zeguro 2025. to help our small business customers understand their cyber risk” Stephanie Watkins, Hartford Steam Boiler

16 This changing landscape means that insurers must adapt their traditional The growth of the sharing economy raises important questions about trust. products, to meet these changing needs in other industries. The trend away from Startupbootcamp 2018 participant Deemly has a role to play here, offering a ownership to borrowing across transport and mobility, property and co-working reputation and social verification tool for peer-to-peer marketplaces. Deemly means insurers must offer new products to serve this market. For example, creates a trust score for users across multiple marketplaces, allowing users Startupbootcamp 2018 startup ForestCar offers a new proposition: an airport car of these services to utilize their entire digital reputation in order to better sharing service, connecting car owners wishing to park at airports with renters participate in all peer-to-peer marketplaces. wishing to access vehicles. ForestCar itself owns no vehicles, and the necessary Sara Green Brodersen, founder and CEO of Deemly highlights the need for insurance product requires multiple parties, including the owner and the renter. collaboration in the sharing economy: “The sharing economy represents a huge It takes a forward thinking insurer to lead the pack and create a bespoke product unlocked potential for insurers to tap in to. By working with startups in this for such an offering. Whilst on the program, ForestCar has secured a partnership space they will have a better understanding of the market and its impact on and with Cuvva, a pay-as-you-go car insurance provider. need for future propositions.” Cyber risk and the sharing economy are just two examples of broad themes where the insurance industry now has an opportunity to innovate and drive value. Strategic partnerships with startups offering expertise and technological know-how in these areas offers huge potential to insurers seeking to explore new areas of growth. Other insurers will choose to watch and wait – but risk losing first mover advantage. “The sharing economy represents a huge unlocked potential for insurers in to tap in to.” Sara Green Brodersen, founder and CEO of Deemly

17 Startupbootcamp applications by insurance line: startups increasingly looking to solve problems in commercial insurance 50% 40% 30% 20% 10% Life & Personal lines Commercial Speciality Reinsurance Multi lines Pensions lines 2016 2017 2018

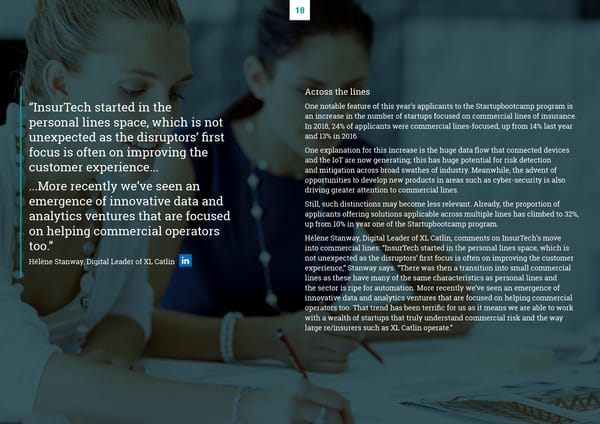

18 Across the lines “InsurTech started in the One notable feature of this year’s applicants to the Startupbootcamp program is personal lines space, which is not an increase in the number of startups focused on commercial lines of insurance. In 2018, 24% of applicants were commercial lines-focused, up from 14% last year unexpected as the disruptors’ first and 13% in 2016. focus is often on improving the One explanation for this increase is the huge data flow that connected devices customer experience... and the IoT are now generating; this has huge potential for risk detection and mitigation across broad swathes of industry. Meanwhile, the advent of ...More recently we’ve seen an opportunities to develop new products in areas such as cyber-security is also driving greater attention to commercial lines. emergence of innovative data and Still, such distinctions may become less relevant. Already, the proportion of analytics ventures that are focused applicants offering solutions applicable across multiple lines has climbed to 32%, on helping commercial operators up from 10% in year one of the Startupbootcamp program. too.” Hélène Stanway, Digital Leader of XL Catlin, comments on InsurTech’s move into commercial lines: “InsurTech started in the personal lines space, which is Hélène Stanway, Digital Leader of XL Catlin not unexpected as the disruptors’ first focus is often on improving the customer experience,” Stanway says. “There was then a transition into small commercial lines as these have many of the same characteristics as personal lines and the sector is ripe for automation. More recently we’ve seen an emergence of innovative data and analytics ventures that are focused on helping commercial operators too. That trend has been terrific for us as it means we are able to work with a wealth of startups that truly understand commercial risk and the way large re/insurers such as XL Catlin operate.”

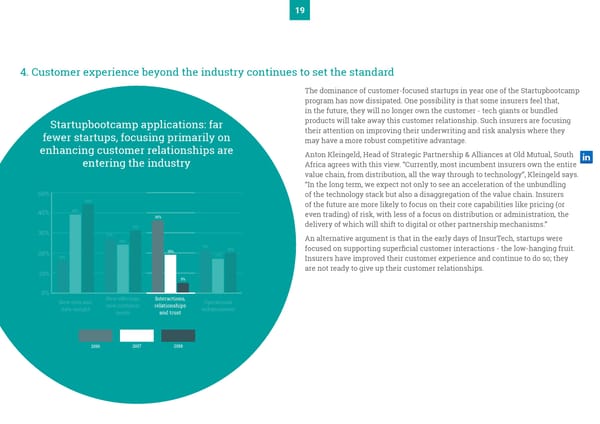

19 4. Customer experience beyond the industry continues to set the standard The dominance of customer-focused startups in year one of the Startupbootcamp program has now dissipated. One possibility is that some insurers feel that, in the future, they will no longer own the customer - tech giants or bundled Startupbootcamp applications: far products will take away this customer relationship. Such insurers are focusing fewer startups, focusing primarily on their attention on improving their underwriting and risk analysis where they enhancing customer relationships are may have a more robust competitive advantage. entering the industry Anton Kleingeld, Head of Strategic Partnership & Alliances at Old Mutual, South Africa agrees with this view. “Currently, most incumbent insurers own the entire value chain, from distribution, all the way through to technology”, Kleingeld says. “In the long term, we expect not only to see an acceleration of the unbundling 50% of the technology stack but also a disaggregation of the value chain. Insurers 44% of the future are more likely to focus on their core capabilities like pricing (or 40% 39% even trading) of risk, with less of a focus on distribution or administration, the 36% 31% delivery of which will shift to digital or other partnership mechanisms.” 30% 27% An alternative argument is that in the early days of InsurTech, startups were 24% 21% 20% focused on supporting superficial customer interactions - the low-hanging fruit. 20% 19% 16% 17% Insurers have improved their customer experience and continue to do so; they 10% are not ready to give up their customer relationships. 5% 0% New data and New offerings, Interactions, Operational data insight new customer relationships enhancement needs and trust 2016 2017 2018

20 Startups will continue to have a role to play. Insurers remain on the lookout for “If tech giants are to become future meaningful improvements to customer interaction. competitors, insurers will never be PicUP, one of the 2018 Startupbootcamp cohort, is an example of what is possible. It offers a phone call optimization platform that personalizes the customer’s able to win on technology alone. incoming call screen so they can see who is calling and why. The company They must capitalize on their enables additional services within the call, such as allowing customers to complete and sign documentation. The effect is to help companies enrich the knowledge and relationships with customer journey with a combined digital and human interaction. For insurers, their customers, and leverage their this has significant appeal, especially in a claims process where customers employees to make the most out of continue to express a desire for human interaction during an emotional time. Lior Shacham, CEO of PicUP says: “If tech giants are to become future human interactions.” competitors, insurers will never be able to win on technology alone. They Lior Shacham, CEO of PicUP must capitalize on their knowledge and relationships with their customers, and leverage their employees to make the most out of human interactions. Empowering their employees with technology, and not replacing them with it, is the best way to leverage their strongest competitive advantage.” A return to the experience of the first Startupbootcamp, when so many participants were focused on the front-end customer relationship, now looks unlikely. Insurers are now pursuing a broader range of collaborations that also focus on back and middle-office innovation; and InsurTechs are increasingly giving attention to commercial lines. Nevertheless, insurers recognize that improving the customer experience requires more than an updated website; startups offering new front-end solutions with clear potential for the insurance sector will continue to be in demand.

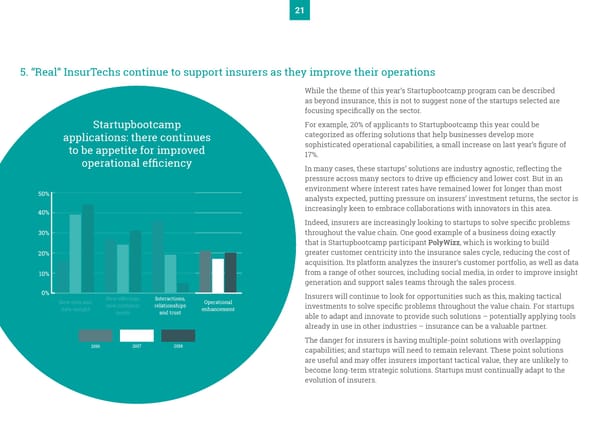

21 5. “Real” InsurTechs continue to support insurers as they improve their operations While the theme of this year’s Startupbootcamp program can be described as beyond insurance, this is not to suggest none of the startups selected are focusing specifically on the sector. Startupbootcamp For example, 20% of applicants to Startupbootcamp this year could be applications: there continues categorized as offering solutions that help businesses develop more to be appetite for improved sophisticated operational capabilities, a small increase on last year’s figure of operational efficiency 17%. In many cases, these startups’ solutions are industry agnostic, reflecting the pressure across many sectors to drive up efficiency and lower cost. But in an 50% environment where interest rates have remained lower for longer than most analysts expected, putting pressure on insurers’ investment returns, the sector is 40% increasingly keen to embrace collaborations with innovators in this area. Indeed, insurers are increasingly looking to startups to solve specific problems 30% throughout the value chain. One good example of a business doing exactly that is Startupbootcamp participant PolyWizz, which is working to build 20% greater customer centricity into the insurance sales cycle, reducing the cost of acquisition. Its platform analyzes the insurer’s customer portfolio, as well as data 10% from a range of other sources, including social media, in order to improve insight generation and support sales teams through the sales process. 0% Insurers will continue to look for opportunities such as this, making tactical New data and New offerings, Interactions, Operational data insight new customer relationships enhancement investments to solve specific problems throughout the value chain. For startups needs and trust able to adapt and innovate to provide such solutions – potentially applying tools already in use in other industries – insurance can be a valuable partner. The danger for insurers is having multiple-point solutions with overlapping 2016 2017 2018 capabilities; and startups will need to remain relevant. These point solutions are useful and may offer insurers important tactical value, they are unlikely to become long-term strategic solutions. Startups must continually adapt to the evolution of insurers.

22 6. The broader value story It would be a mistake to look only at the tangible results of InsurTech innovation. More generally, insurers’ approach to Startupbootcamp reflects these partners’ In fact, startups in the sector are having an impact in many different ways. stories: i. An evolving culture of innovation • In year one of the program, many firms focused on watching and learning. Over three years of Startupbootcamp, InsurTech has brought real value to Both fearful and curious about the startups, insurers were happy to incumbents, and that value continues to shift as the ways in which insurers engage from the side-lines. But even in the absence of large numbers of embrace innovation continue to evolve. partnerships, the watch and learn approach stimulated in-house innovation. Insurers set up innovation teams to explore opportunities for transformation. Fiona Williams, Business Development Executive at Admiral explains the way in • In year two, the focus moved to tactical solutions and talent. A year on, which her business’s interaction with InsurTech startups continues to change. startups embraced collaboration with insurers, and we saw the uptake “At Admiral we have a test and learn approach and are always keen to explore of proof of concepts in tactical points across the value chain. Examples new ways of doing things and improving our service to our customers whether included digital processing of claims; white labelled distribution platforms. that is through trialling new software to optimize our existing service or offering our customers an entirely new product proposition”, Williams says. “In the next • In year three of the program, insurers are starting to scale proof of concepts, few years we will continue to be interested to monitor the ever-changing startup but are looking to overcome understandable hesitation from risk and landscape with a view to partnering where we see we can create an even better compliance teams in taking experimentation to execution. value proposition for both our new and existing customers.” The opportunity for insurers is to further capitalize on this innovation by Hélène Stanway, Digital Leader of XL Catlin, says: “Insurers have to evolve and co-creating the new value propositions. The alternative is to watch as this show buyers that they are capable of innovating. That is the only way to remain innovation takes place. But while insurers will still see some benefits from attractive and competitive and is what will make a difference in the next 5, 10, 15 this approach – reduced claims from customers using third-party preventive years. The industry needs to embrace the opportunity for change. At XL Catlin, services, for example – there will also be impacts; not least, these customers we have made it one of our core values to be future-focused, and that means that will expect lower premiums. Instead, engaging with co-creation provides a route collaborating with InsurTech companies is key to our strategy.” to stronger relationships with clients, and the potential to increase revenue in prevention, where there is more space to grow. Collaborate, don’t react: what the startups say

23 Teemu Ala-Hynnilä, CEO and co-founder of Flowenum, says the prevention and prediction value proposition his business offers has obvious appeal to insurers. “By partnering with insurers, my “We think this is a perfect fit for collaboration with insurers,” Ala-Hynnilä says. team can focus on continually “Insurers are experts in risk management already, so to provide this service to improving our technology, customers is not a big leap from how a customer thinks of an insurer already.” From the perspective of startups, moreover, the opportunity is access to rather than focusing on sales customers and the trusted relationships they have with their insurers. Their and marketing.” business model may be based on a service bundled in with an insurance product or provided on a standalone basis that adds value either for the insurer or the Ram Srinivasan, co-founder of ZASTI customer. Ram Srinivasan, co-founder of ZASTI, has worked with insurers that are taking different approaches to collaboration. While some are looking to recommend ZASTI’s predictive analytics platform to their clients in return for a reduced premium or a customized insurance product, others would like to white label the platform, offering it to their customers as an additional service. For ZASTI, the latter approach is the preferred method. “By partnering with insurers, my team can focus on continually improving our technology, rather than focusing on sales and marketing,” says Srinivasan. “This partnership method is also more lucrative for the insurers, meaning we can develop longer- term strategic partnerships that provide value to the end customer”. However, he acknowledges that at least in the short term, insurers are keener to keep their environments separated, with legal and risk teams anxious not to expose themselves to risk.

24 However, there are a number of barriers to overcome in order to embed One challenge will be in tackling the failure is not an option mentality, managing innovation in a meaningful way within the business: the risk that innovation inevitably brings. Indeed, while many InsurTech • Innovation not aligned to strategy - often, innovation and proof of concept solutions are predicated on helping the insurance sector better manage risk, collaborations have taken place in areas not aligned with the strategic experimentation with new ideas carries risks of its own. Not every initiative will direction of the company. Such exercises may generate positive learnings deliver the hoped-for results; insurers will need to be ready to change tack or but are unlikely ever to reach scale. Both insurer and startup resources could simply to back off as the situation requires. A commitment to “fail fast” is a key be better deployed elsewhere. element of successful innovation. • Lack of ownership from business units – for now, much of the innovation Understandably, risk and compliance teams are concerned about working with and progress with startups is being driven from insurers’ satellite innovation unproven and new startups. Partnering and scaling with a startup, opens up the teams. Such teams are a step in the right direction, but this approach can business to risk, but taking the easier option of keeping the partnered startup at lead to many organizations struggling to embed an innovation mindset in arms-length (see earlier section on partnership model) means that insurers don’t their businesses. The innovation teams’ main barrier, and what should be top see the benefit of the collaboration. of the priority list, is getting buy in from the business units. How do insurers move forward? Innovation teams have had great success in scouting relevant startups and creating proof of concepts. They are now looking to be as embedded as possible within business units. Consider: • Running strategy or problem-solving workshops with business units; supporting them to express their pain points will help encourage business units to get involved; • Celebrating and promoting success; the innovation team should promote successful proof of concepts that meet the needs of the business as widely as possible, including externally; • Allocating KPIs and resources within business units since a leadership truly invested in innovation will carve out the time and resources necessary for business units to embrace it - giving allocated time and KPIs demonstrates the priority the business is giving to this.

25 Lloyds Banking Group, Innovation Journey Startupbootcamp is evolving its program in order to meet these changing requirements of innovation. Derek Smith, Head of Insurance Innovation for those problems. We then look to plug in Startupbootcamp is reinforcing partnerships with at Lloyds Banking Group (LBG) reflects on the startups that support us to reach that vision. operational units to ensure the commitment to change in innovation mindset at LBG since meaningful and focused execution. To help create becoming an SBC partner three years ago. Where a few years ago we would have looked a culture of innovation, Startupbootcamp is aware to build a new proposition entirely on our own, that there is a growing need for execution, where “We initially joined as a partner to gather we would now look to build and partner with the emphasis will be first on identifying the pains insight from thinking outside of insurance. We startups. In the future, we will continue to use insurance companies have and creating a small understood that we did not have a complete view the power of our InsurTech network to identify innovation team which will be able to provide of our customers’ changing needs, and were and test future propositions, as well as look to a solution through collaboration with startups. therefore not meeting them. We joined to explore select strategic partners to support the growth Startupbootcamp’s mission is to ensure that how InsurTech could help us to identify and meet of our business.” insurance partners get the right mechanisms and those needs. What we didn’t comprehend was LBG’s transformational shift away from a leadership in place to accelerate brilliant ideas. the scale of cultural benefit that collaborating traditional organizational structure, towards ii. Access to talent and diversity with Startupbootcamp and the startups would customer focused, co-located teams is bring. From talent and ways of working, to new supporting this innovation journey. By creating Last year’s report highlighted the increase in propositions and a view of the customer beyond self-contained business units, with product the number of startups with team members who financial services, we have benefited greatly. owners and engineers working together to had insurance expertise. This was important as Not only has there been an impact on culture own the full customer journey, they are able InsurTechs moved beyond a focus on front-end within our business, but our approach to to make their own decisions with a strong use cases to broader operational problems within innovation has evolved. We are no longer finding customer focus and go to market quicker. insurance. We are now increasingly seeing teams a point solution and looking at how to apply it to with either deep expertise in technology, or in our business, but we are now bringing together another industry, with advisors or board members themes we see in the market, defining problem bringing the insurance expertise. As more startups statements for the medium term strategy of our focus on innovation beyond insurance and work business and designing proposition ideas to solve with insurers to build a broader ecosystem of InsurTech, new skills are flowing into the industry.

26 This is very welcome. PwC’s 21st CEO Survey 2018 warned insurance industry 1 in 5 CEOs agreed it was ‘very CEOs are very concerned about the availability of digital skills in the industry, more than other financial services industries. A fifth of insurance company CEOs difficult’ to attract digital warned it was very difficult to attract such talent to the industry while 45% said talent into the industry. they hoped to partner with external providers to secure these skills. 45% hope to partner Startup founders and team members can bring deep expertise from other industries. Peter Bunus, the CEO of Startupbootcamp 2018 cohort member with external CyStellar, is an excellent example. Dr. Bunus has co-founded a string of high- tech ventures, growing several businesses to scale, and worked extensively in providers to secure academia and science. digital skills. Startups clearly bring diversity from a skills and geographic perspective, but we 20% are yet to see true gender diversity from InsurTech startups. Of the >1000 startup applications, we analyzed the makeup of 226. Only 23% of applicants to this year’s program had a female founder. Although this is an improvement from last year’s statistic of 16%, it still highlights the gender imbalance. Looking at the types of roles that women typically have within these startups, compared to the roles men have, the starkest difference is when we look at Chief Technology Officer (CTO) and Chief Marketing Officer (CMO) roles, men are five times more likely to be a CTO, where women are twice as likely to be CMO.

27 Applicant Team Comparing the proportion of Members by men and women’s roles Gender FEMALE TEAM MEMBERS 55% 3% 12% 14% 3% 2 11% 12% CEO CTO COO CMO CPO CFO OTHER 88% 56% 15% 9% 7% 4% 3% 6% MALE TEAM MEMBERS Note: Of the >1000 startup applications, 226 teams were analyzed by role and gender

28 This statistic is part of a wider problem. PwC’s 2017 “Women in Tech, time to close the gender gap” report spoke to over 2000 A-level students to highlight that the gender gap in technology is still prevalent in schools and will therefore impact career choices in the future. Only 8% of young women say a career in technology is their first choice, or one of their first choices, compared to 34% of young men. This is a vicious circle: without female role models, there is 8% a lack of visibility of role models for young women 78% to aspire to; combined with a lack of career advice to girls to get into technology, enforcing the gender 8% of young women say stereotype. of students can’t name a PwC is trying to combat these issues with, for a career in technology is famous female working example, the TechSheCan initiative and a new their first choice, or one in technology network, Women in Insurance and Technology. This of their first choices network aims to take decisive action to combat the pyramid effect of the decreasing proportion of women working in this area as seniority increases. Some of the actions the network is exploring are: the wording of job adverts to ensure gender neutral language; reverse mentoring with more junior women mentoring senior men; and Lean In’s initiative, MentorHer. 16% 5% of females have had a of leadership career in technology positions in the suggested to them (35% technoligy sector are of males) held by women

29 7. What next for InsurTech? The outlook for InsurTech startups is bright. Not every new venture will succeed Data-driven innovation will continue to increase but in a sector that is hungry for innovation – and increasingly willing to look At their heart insurers are data companies and we therefore expect to see a beyond its boundaries for new ideas and solutions – the best startups have every continued interest and investment in data focused startups and continued chance of commercial success, whether in collaboration with incumbents or on a investment in data analytics. Some 50% of partners surveyed say they are already standalone basis. working with data analytics providers in their business-as-usual activities, while i. The short-term outlook for InsurTech the other 50% are either in development or looking to develop relationships. Innovation becomes BAU beyond the innovation team to the This investment will further enhance underwriting and claims. Some 83% of business units partners agree that data analytics will be transformative in these areas. Innovation teams have shown success, but in less mature environments Innovation will grow in commercial and speciality lines these teams can struggle to gain buy-in from other parts of the organization, To date, most innovation has been centered on personal lines of insurance, hampering efforts to encourage change at a business unit level. particularly around customer engagement and the front end. But as insurers are As maturity of innovation teams grow, they will continue to establish better able to exploit data, they will be able to innovate further into commercial relationships with business units, who will take a more proactive approach when and speciality lines, moving towards prevention and mitigation rather than risk it comes to going to the innovation team with problem statements they wish to transfer. find new solutions to. This culture change does not, however, happen without As part of this trend, we expect to see greater innovation within broker concerted effort. distribution. Customers will expect an omni-channel experience. Clients will One other question for insurers to address in this area is the role of the C-suite. value advice on risk from their brokers ahead of access to insurance. At very few organizations is the head of innovation currently a board-level role. ii. The longer-term outlook for InsurTech “InsurTech” will cease to be a relevant term We expect to see the language around innovation in insurance change. As a focus on technology and innovation becomes an everyday and essential part of operating a competitive insurance business, the idea of standalone InsurTechs will become as outdated as the concept of having a separate digital strategy for the company. Instead, InsurTech will become an innovation ecosystem in and around insurance, with insurers working with a range of partners from within the industry and beyond.

30 Greenfield insurers will evolve Insurers will learn from the broader FinTech community, building their own greenfield operations based on straight-through digital processing. This will span not only distribution and transactional business but also claims and dynamic underwriting. In this way, insurers will move past the inflexible and inaccessible legacy systems currently acting as a barrier to innovation, with greenfield insurers embracing a modular approach. Disruption from scale-ups and big tech As well as competition from tech giants, we expect to see startups coming together to become disruptive scale-ups with broader capabilities and ambitions. Startups with specialization in different parts of the value chain may come together to launch their own greenfield operations. In this scenario, we expect these scale-ups to work directly with first mover reinsurers to provide capacity, cutting incumbent providers, and slower reinsurers out of the mix.

31 Closing Remarks When we started Startupbootcamp InsurTech three years ago, we did not expect With this statement, we want to stress to market players - makers and that InsurTech as a topic, would become engrained as a key component of participants - that anyone in insurance interested in the cultural change and the way business is done in insurance so fast. We learnt a lot from observing innovation that InsurTech companies can generate either through collaboration, retail-based propositions emerge, seeing InsurTech move from consumer-led to partnership or investment opportunities, must look at the problem with a business-led propositions, as they combine more advanced sets of capabilities different lens. Insurance is everywhere. This means that digital capabilities and technologies to solve more complex problems. brought about by InsurTech and other new ventures will potentially touch every From Mexico to Singapore, we were able to identify, accelerate, invest and facet of our world and ecosystem, to address very specific issues ranging from support over 50 InsurTech startups across our InsurTech, FinTech and Cyber- the protection gap, serving the underserved, or the impact of a potential fourth security programs. We were able to classify how InsurTech combined with industrial revolution on insurance. PropTech (BuzzMove/ BuzzVault); IoT (Fing); AgriTech (Aerobotics, Cystellar); I feel very privileged to be working with forward thinking businesses, young Aircraft Manufacturing (Zasti); Supply Chain (Adapt Ready, Statwig) or the and old, that are truly engaged in reshuffling, disaggregating and reinventing Sharing Economy (Valoo, ForestCar) could solve very unique challenges across customer propositions and value chains from back to front. And I look forward to the insurance value chain. Insurers and InsurTechs have so far engaged in over helping them identify those unique differentiating models that will make their 300 pilots with some well-publicised success. business survive, thrive and excel for the years to come. Emerging technologies combined with a demand-driven market have pushed Through this process we also hope to contain the “innovation theatre syndrome” businesses and innovators to consider transparency and trust as a core part of which delivers few results. But for now, it is part of our current reality. their customer propositions. Sharing economy entrants and the tech giants have Sabine VanderLinden both facilitated the move toward such core principles and building blocks of tech-led offerings. CEO, InsurTech Business, Startupbootcamp & Rainmaking Today, insurers are seeking means for driving profitable growth and of identifying new possibilities for differentiation. As part of this search, seeking relevance from adjacent industries as a means for inspiration is becoming part of that equation. As we now predict that “InsurTech will be ‘Insur’Tech no more” we know that this statement will trigger a few raised eyebrows as InsurTech was only truly established four years ago – whilst FinTechs have now existed for 12 years and are still going strong, challenging bank thinking and financial services infrastructure.

32 Conclusion Last year, the InsurTech report from PwC and Startupbootcamp predicted we would see more cross industry collaboration, but this year we have been “As we see insurers invest more surprised by the pace that this is starting to happen. in their innovation capabilities, Most startups are no longer talking about disrupting the market, but understand their place within the InsurTech ecosystem - how they can add value to insurers looking to scale with startups and bring in expertise, or data, from outside the industry. beyond proof of concepts, we can Although startups who providing better data and insights within existing conclude that this ecosystem is still underwriting models are already adding value to insurers, we look forward to the exciting opportunities that will be possible as insurers replace legacy technology, set to grow and mature - becoming a allowing for greater interaction with third parties. core part of the insurance industry” Startups will continue to play a role in supporting insurers to improve efficiency and customer interactions across the existing value chain and beyond. As we Victoria Newton, PwC Advisor see insurers invest more in their innovation capabilities, looking to scale with in Residence to Startupbootcamp startups beyond proof of concepts, we can conclude that this ecosystem is still set to grow and mature- becoming a core part of the insurance industry.

Startupbootcamp InsurTech Startupbootcamp InsurTech is the leading insurance accelerator focused on innovation for the insurance industry. The award-winning accelerator provides InsurTech startups with mentorship, sustainable design, and key growth resources, and offers access to world class industry expertise during an intensive three-month program. The PwC programs are supported by industry partners, as well as an PwC works with insurance companies to implement extensive mentor and alumni network from more than 30 InsurTech innovation, from strategy through countries across the globe. execution, and helps InsurTech start-ups accelerate and scale their businesses to reach their full potential. Sabine VanderLinden CEO, InsurTech Business, Startupbootcamp & Rainmaking Jonathan Howe sabine@startupbootcamp.org Global InsurTech Leader PwC jonathan.p.howe@pwc.com Tshidi Hagan Steven Gough Program Director Startupbootcamp InsurTech UK Insurance Customer & Tech Leader PwC “PwC” refers to the UK member firm, and may sometimes tshidi@startupbootcamp.org steven.j.gough@pwc.com refer to the PwC network. Each member firm is a separate legal entity. Please see Ana Šemrov Victoria Newton www.pwc.com/structure for further details. InsurTech Analyst (report researcher) InsurTech Consultant (report author) ana.semrov@startupbootcamp.org victoria.s.newton@pwc.com © 2018 Startupbootcamp InsurTech. All rights reserved.