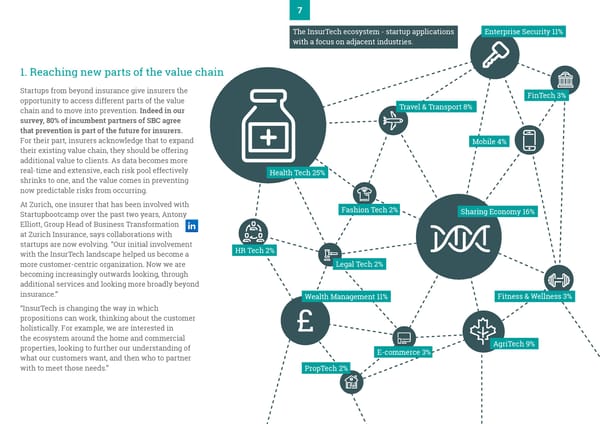

7 The InsurTech ecosystem - startup applications Enterprise Security 11% with a focus on adjacent industries. Figur 1. Reaching new parts of the value chain e 2: Th Startups from beyond insurance give insurers the e Insur opportunity to access different parts of the value FinTech 3% T chain and to move into prevention. Indeed in our Travel & Transport 8% ech survey, 80% of incumbent partners of SBC agree ecosyste that prevention is part of the future for insurers. For their part, insurers acknowledge that to expand Mobile 4% m- star their existing value chain, they should be offering additional value to clients. As data becomes more tup app real-time and extensive, each risk pool effectively Health Tech 25% shrinks to one, and the value comes in preventing lications now predictable risks from occurring. At Zurich, one insurer that has been involved with Fashion Tech 2% with Sharing Economy 16% Startupbootcamp over the past two years, Antony a Elliott, Group Head of Business Transformation focus at Zurich Insurance, says collaborations with on startups are now evolving. “Our initial involvement oth HR Tech 2% er with the InsurTech landscape helped us become a in more customer-centric organization. Now we are Legal Tech 2% dustries. becoming increasingly outwards looking, through additional services and looking more broadly beyond insurance.” Wealth Management 11% Fitness & Wellness 3% “InsurTech is changing the way in which propositions can work, thinking about the customer holistically. For example, we are interested in £ the ecosystem around the home and commercial AgriTech 9% properties, looking to further our understanding of E-commerce 3% what our customers want, and then who to partner with to meet those needs.” PropTech 2%

Breaking Boundaries | PwC & Startupbootcamp Page 7 Page 9

Breaking Boundaries | PwC & Startupbootcamp Page 7 Page 9