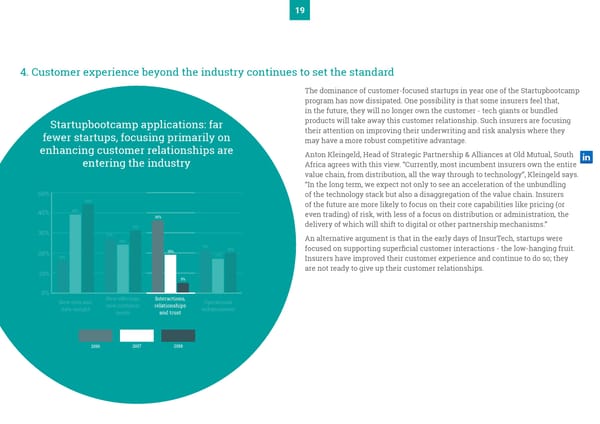

19 4. Customer experience beyond the industry continues to set the standard The dominance of customer-focused startups in year one of the Startupbootcamp program has now dissipated. One possibility is that some insurers feel that, in the future, they will no longer own the customer - tech giants or bundled Startupbootcamp applications: far products will take away this customer relationship. Such insurers are focusing fewer startups, focusing primarily on their attention on improving their underwriting and risk analysis where they enhancing customer relationships are may have a more robust competitive advantage. entering the industry Anton Kleingeld, Head of Strategic Partnership & Alliances at Old Mutual, South Africa agrees with this view. “Currently, most incumbent insurers own the entire value chain, from distribution, all the way through to technology”, Kleingeld says. “In the long term, we expect not only to see an acceleration of the unbundling 50% of the technology stack but also a disaggregation of the value chain. Insurers 44% of the future are more likely to focus on their core capabilities like pricing (or 40% 39% even trading) of risk, with less of a focus on distribution or administration, the 36% 31% delivery of which will shift to digital or other partnership mechanisms.” 30% 27% An alternative argument is that in the early days of InsurTech, startups were 24% 21% 20% focused on supporting superficial customer interactions - the low-hanging fruit. 20% 19% 16% 17% Insurers have improved their customer experience and continue to do so; they 10% are not ready to give up their customer relationships. 5% 0% New data and New offerings, Interactions, Operational data insight new customer relationships enhancement needs and trust 2016 2017 2018

Breaking Boundaries | PwC & Startupbootcamp Page 19 Page 21

Breaking Boundaries | PwC & Startupbootcamp Page 19 Page 21