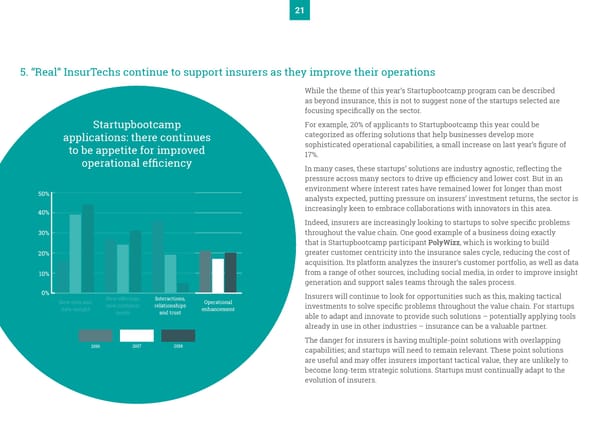

21 5. “Real” InsurTechs continue to support insurers as they improve their operations While the theme of this year’s Startupbootcamp program can be described as beyond insurance, this is not to suggest none of the startups selected are focusing specifically on the sector. Startupbootcamp For example, 20% of applicants to Startupbootcamp this year could be applications: there continues categorized as offering solutions that help businesses develop more to be appetite for improved sophisticated operational capabilities, a small increase on last year’s figure of operational efficiency 17%. In many cases, these startups’ solutions are industry agnostic, reflecting the pressure across many sectors to drive up efficiency and lower cost. But in an 50% environment where interest rates have remained lower for longer than most analysts expected, putting pressure on insurers’ investment returns, the sector is 40% increasingly keen to embrace collaborations with innovators in this area. Indeed, insurers are increasingly looking to startups to solve specific problems 30% throughout the value chain. One good example of a business doing exactly that is Startupbootcamp participant PolyWizz, which is working to build 20% greater customer centricity into the insurance sales cycle, reducing the cost of acquisition. Its platform analyzes the insurer’s customer portfolio, as well as data 10% from a range of other sources, including social media, in order to improve insight generation and support sales teams through the sales process. 0% Insurers will continue to look for opportunities such as this, making tactical New data and New offerings, Interactions, Operational data insight new customer relationships enhancement investments to solve specific problems throughout the value chain. For startups needs and trust able to adapt and innovate to provide such solutions – potentially applying tools already in use in other industries – insurance can be a valuable partner. The danger for insurers is having multiple-point solutions with overlapping 2016 2017 2018 capabilities; and startups will need to remain relevant. These point solutions are useful and may offer insurers important tactical value, they are unlikely to become long-term strategic solutions. Startups must continually adapt to the evolution of insurers.

Breaking Boundaries | PwC & Startupbootcamp Page 21 Page 23

Breaking Boundaries | PwC & Startupbootcamp Page 21 Page 23